M&A Blog #06 – debt (Part I – role and trade-offs, categories and key characteristics)

Francine Way

MAY 14, 2017

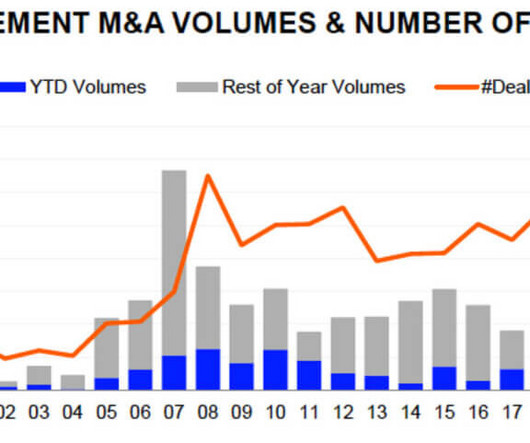

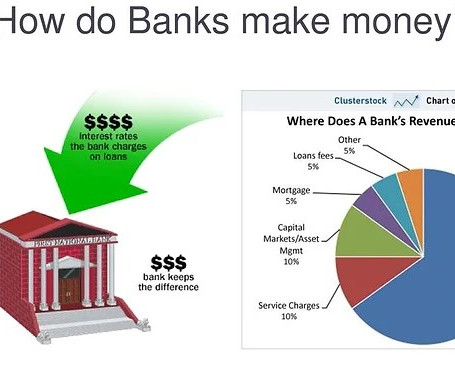

In the last two blog posts, we walked through capital structure and how it impacts M&A activities and vice versa. To be explicitly clear, I am recommending the use of the following ranked capital sources when paying for an acquisition: cash (from the balance sheet), debt (at a reasonable level), and equity.

Let's personalize your content