Trader of the Year Hedge Fund: Conversant Capital’s David Alfred

The TRADE

JANUARY 22, 2025

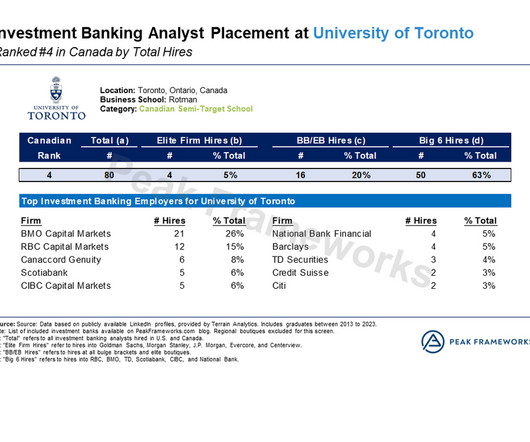

I spent the first 20 years of my career at the global bulge bracket banks, first in investment banking and then on the institutional equity desks, in a cross-asset and special situations role. I started my career at Bear Stearns in 2001, then migrated to Credit Suisse in 2008. There’s been a reopening in capital markets.

Let's personalize your content