Indemnity Escrows

What's Market

AUGUST 29, 2022

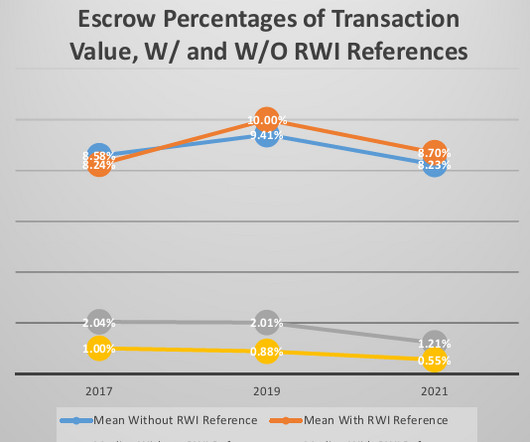

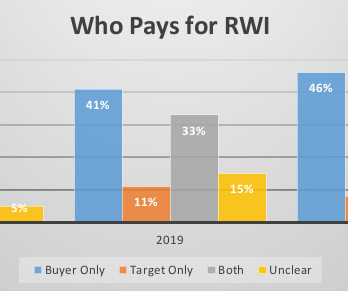

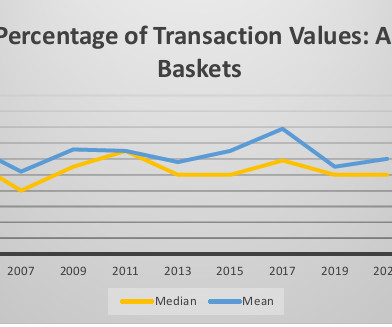

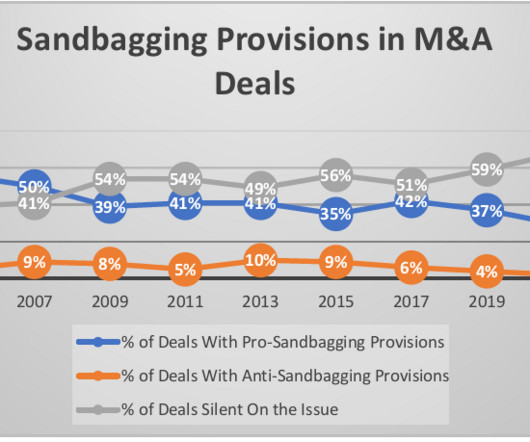

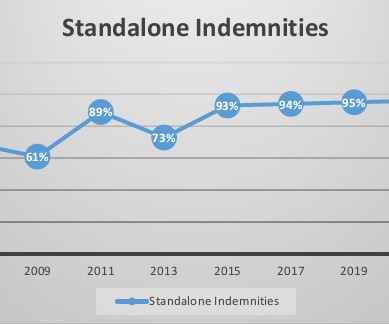

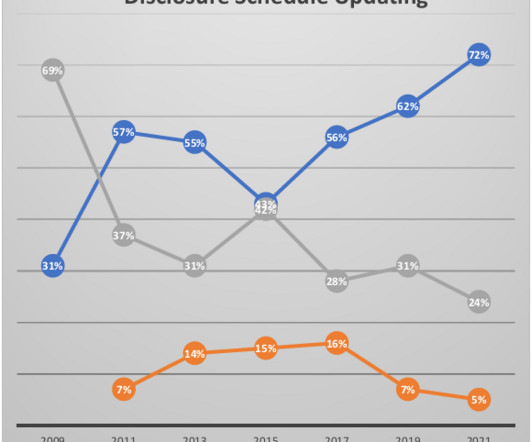

Market Trends: What You Need to Know As shown in the American Bar Association's Private Target Mergers and Acquisitions Deal Points Studies: Indemnity escrows are consistently seen in about two-thirds or more of reported transactions.

Let's personalize your content