These are the 10 most overvalued stocks in the S&P 500

CNBC: Investing

APRIL 18, 2024

CNBC Pro screened FactSet data for stocks in the S&P 500 that have the largest premium valuation compared to their recent history.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

CNBC: Investing

APRIL 18, 2024

CNBC Pro screened FactSet data for stocks in the S&P 500 that have the largest premium valuation compared to their recent history.

CNBC: Investing

FEBRUARY 28, 2024

The S&P 500 today is higher quality and has lower earnings volatility than in prior decades, making it a "different animal," BofA's Savita Subramanian said.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Sun Acquisitions

OCTOBER 13, 2023

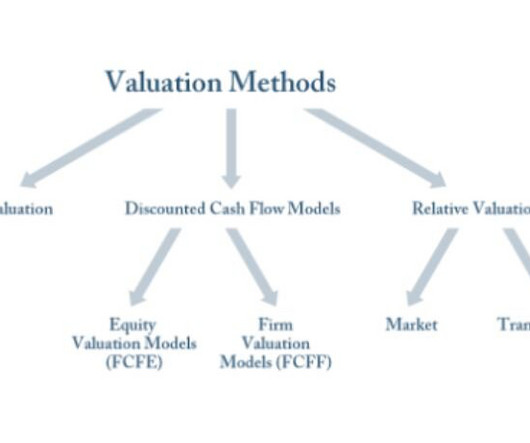

Valuation lies at the heart of every successful M&A transaction, providing a framework to determine the worth of a target company. Valuation techniques in M&A involve a comprehensive assessment of financial, operational, and market factors. Discounted Cash Flow (DCF) analysis is a commonly used income-based valuation technique.

Deal Lawyers

APRIL 23, 2024

Despite a bit of a checkered reputation, non-SPAC reverse mergers are still a thing, and this excerpt from a recent WilmerHale memo (p. 14) says that there’s been an uptick in these deals and that, for some companies, they are an attractive alternative to an IPO: The trend of declining public company valuations (including a […]

Software Equity Group

MAY 8, 2024

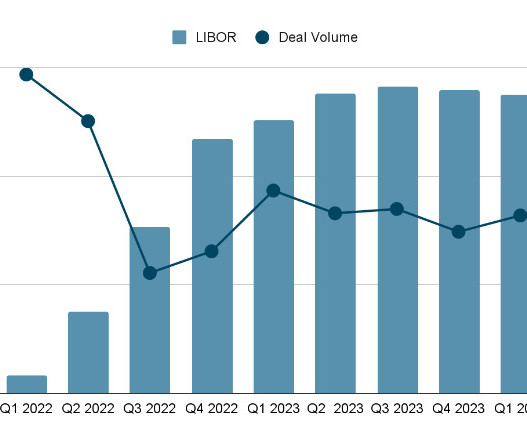

But what are the key influences shaping valuation multiples in today’s M&A deals? As you contemplate your exit strategy, it becomes increasingly crucial to understand the external factors driving the valuation of your SaaS company. It’s important to remember that no key metric exists in a vacuum.

Software Equity Group

MAY 7, 2024

But what are the key influences shaping valuation multiples in today’s M&A deals? As you contemplate your exit strategy, it becomes increasingly crucial to understand the external factors driving the valuation of your SaaS company. It’s important to remember that no key metric exists in a vacuum.

Sun Acquisitions

NOVEMBER 17, 2023

Valuation is the process of determining the worth of a business, and it plays a pivotal role in M&A transactions. Why Market Value Matters in M&A Valuation is the cornerstone of any M&A transaction. Why Market Value Matters in M&A Valuation is the cornerstone of any M&A transaction.

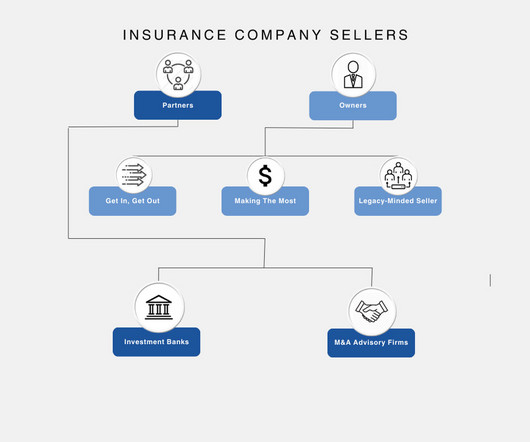

Sica Fletcher

MARCH 12, 2024

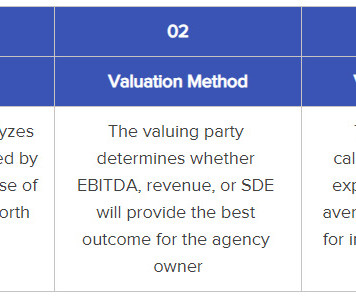

As one of the most active M&A firms in the insurance sector, we are frequently asked how insurance agency valuations work. This article discusses the fundamentals of insurance agency valuations, plus a few lesser-known factors that play into these processes before we give an overview of the insurance M&A market in 2024.

CNBC: Investing

SEPTEMBER 13, 2023

CNBC Pro looked for stocks with both the largest valuation premium in the S&P 500 and that fewer than 50% of analysts covering them rate a buy.

Sica Fletcher

MARCH 14, 2024

Insurance agency valuation is a critical component of running an M&A deal, but executing this multi-step process well requires a great deal of specialized education and experience. In addition, getting the valuation process started demands a hefty bill and entails poring over extensive documentation for several weeks.

Francine Way

JUNE 22, 2020

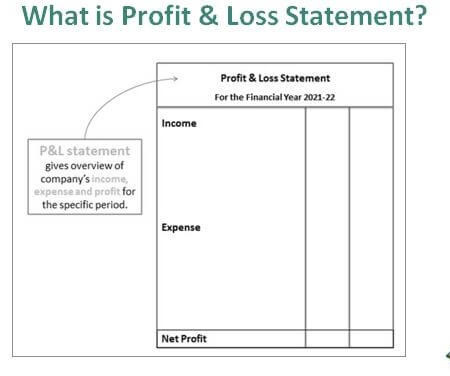

To pick up where we last left off with valuation, I will cover the topic of a Merger Relative Valuation in this blog post and move on to other non-valuation topics from here. A discussion of the target’s financials typically starts with the P/L or Income Statement, followed by the Balance Sheet, and then the Cash Flow Statement.

Francine Way

JULY 11, 2017

Just as any home appraiser or credit officer does before going through the analytical exercise to produce a score for a home or a borrower, valuation professionals go through several steps of preparation before the actual exercise of producing a number that can be used as a value of a company.

Francine Way

JULY 12, 2017

As I mentioned in my last post, Discounted Cash Flow (DCF) is a valuation method that uses free cash flow projections, a discount rate, and a growth rate to find the present value estimate of a potential investment. Calculate the Equity Value and the per-share Equity Value - this number would serve as the base case share price valuation.

Sica Fletcher

APRIL 30, 2024

This article presents a step-by-step guide on how to value an insurance agency - both in the sense of how a valuation agency/M&A advisor goes about valuation, and also in terms of what insurance agency owners can do to maximize their valuation prior to running an M&A deal.

Mergers and Inquisitions

MAY 3, 2023

To be fair, in some industries – like commercial banks and insurance within FIG – the DDM is a core valuation methodology. In other words, you profit based on the company’s dividend s and the potential increases in its stock price over time. The post The Dividend Discount Model (DDM): The Black Sheep of Valuation?

TKO Miller

AUGUST 30, 2023

middle market valuation multiples and deal volume are down slightly through Q2 of 2023. The S&P 500 Index is up 16.5% this year through June 2023, but middle market valuations are down approximately 8% based on the TKO Miller analysis. Packaging Trends Q2 M&A Update U.S.

Sica Fletcher

FEBRUARY 8, 2024

S&P Global’s 2023 Market Intelligence League Table Released NEW YORK, NY - February 8, 2024 - Sica | Fletcher, a premier financial advisory firm, retains its commanding presence in the #1 spot on S&P Global’s Market Intelligence League Table, a position the firm has held quarter-over-quarter since 2017.

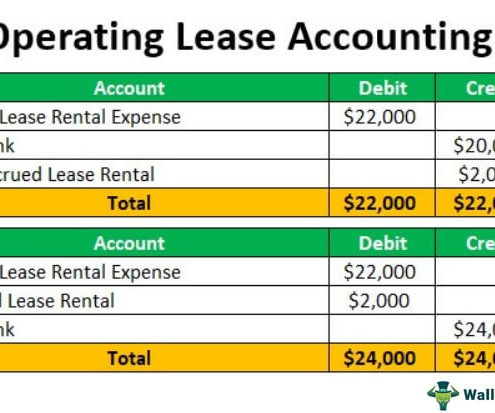

Wall Street Mojo

JANUARY 17, 2024

A profit and loss (P&L) statement, sometimes called as an income statement, is a financial report that provides investors and outsiders with a financial overview of a company. The P&L outcome plotted on a trendline assists investors in understanding the organization’s performance over time.

Wizenius

APRIL 8, 2023

Equity Value (today) = Equity Value at end of forecast period/ (1+Target rate of Return)^n 4) Because this is the valuation of the start-up before the VC invests his/her money in the business it is known as Pre-Money Valuation of the start-up 5) VC investors receive an equity share of the business in exchange for their investments.

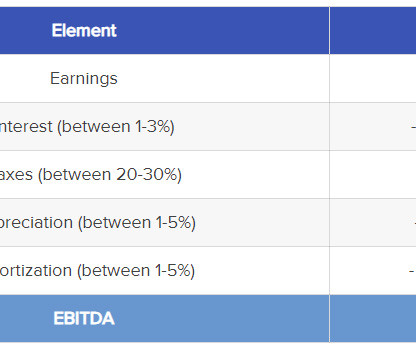

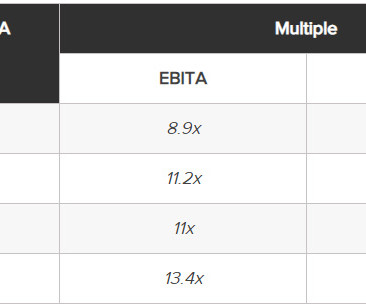

Sica Fletcher

MAY 15, 2024

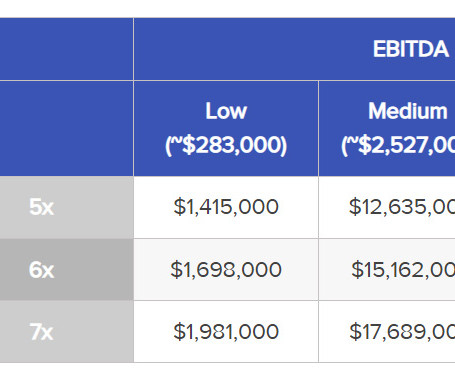

essentially boils down to three major steps: Determine your insurance agency’s EBITDA Determine the standard valuation multiple for an agency of your size Multiply your EBITDA by the multiple to determine your expected payout (i.e.,

Sica Fletcher

APRIL 2, 2024

Insurance M&A Deal Valuation, 2024 Starting out in 2024, EBITDA and revenue multiples are in a good place, experiencing modest YoY growth despite the economic downturn of the last 18 months. In deals with the highest earnout, business owners turn to a specialized M&A advisory firm to handle negotiations and oversee valuations.

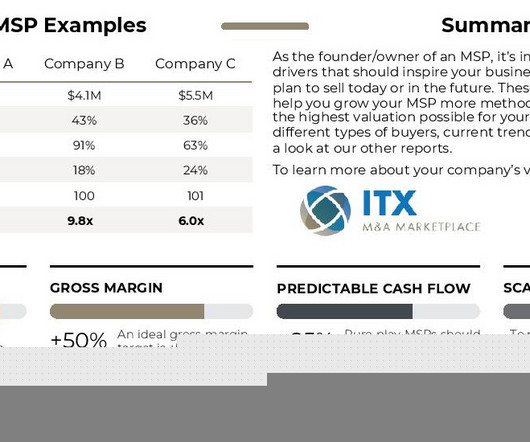

How2Exit

OCTOBER 6, 2022

Revenue Growth: While demonstrated revenue growth and a solid pipeline will lend itself to higher valuations, the quality of that revenue growth is also important. Gross Margin: Gross Margin is one of the most important lines on your P&L and is the way buyers measure how efficiently your MSP makes money.

FineMark

JANUARY 17, 2024

The equity market also noted the Fed’s comments as investors piled back into equities and the S&P 500 finished the year up more than 26%. What’s intriguing about the chart in Figure 2 is how differently equities, as measured by the S&P 500, performed under each period, returning a modest 5.7%

Wizenius

JUNE 12, 2023

Identify companies with similar risk profiles and revenue volatility and analyze their valuation multiples, such as price-to-earnings (P/E) ratio or enterprise value-to-EBITDA (EV/EBITDA) ratio. Apply these multiples to the subject company's financial metrics to derive a valuation range. Thanks, Pratik S

Sica Fletcher

MARCH 8, 2024

Starting in H2 2022, the insurance M&A market has seen a notably difficult 18-month period, afflicted with high interest rates, lowered deal volumes, and lowered valuations. If they do, then we can expect to see valuations and, by extent, EBITDA multiples for insurance agencies rise. Learn more at , ,, SicaFletcher.com.

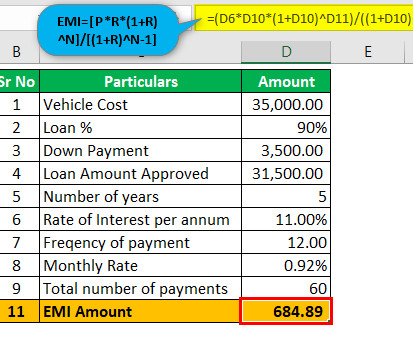

Wall Street Mojo

JANUARY 15, 2024

About Loan [P*R*(1+R)^N]/[(1+R)^N-1] Wherein, P is the loan amount R is the rate of interest per annum N is the number of period or frequency wherein loan amount is to be paid Loan Amount (P) The loan Amount $ ROI per annum (R) Rate of Interest per annum % No. How to Calculate? Each of such points cost 1% of the loan amount.

Mergers and Inquisitions

JANUARY 31, 2024

They might have separate teams for specific strategies or markets, but everything is run under a single Profit & Loss statement (P&L). There are very few real “requirements” besides the single PM / single P&L one above and the standard Limited Partner / General Partner structure that all hedge funds use.

Sica Fletcher

MAY 8, 2024

While we’ve already written extensively on the process of insurance agency valuation , the following sections focus on what to look for in the earliest stages of considering a sale - in other words, what deciding factors to look for to determine whether you should sell your agency. What Documents Do I Need? hidden behind a paywall or b.)

Sica Fletcher

APRIL 11, 2024

Your agency valuation will play a large role in influencing how buyers perceive your agency’s worth. Take time before bringing your agency to market to optimize your daily operations, thus increasing the likelihood of a higher valuation. Pay close attention to the multiple being offered.

How2Exit

OCTOBER 3, 2022

As the founder/owner of a Managed Services Provider (MSP), it’s important to know the value drivers that should inspire your business strategies -- whether you plan to sell today or in the future. It’s the best starting point toward achieving an optimal net profit. Within the MSP space, data security remains white hot.

Solganick & Co.

DECEMBER 21, 2023

While overall deal volume dipped slightly compared to the record-breaking highs of 2022, falling by around 5%, the total value of transactions remained surprisingly resilient, hovering near the $400 billion mark, according to data from S&P Global Market Intelligence.

Successful Acquisitions

SEPTEMBER 11, 2023

The Verdict is In on the Sell Side: Business Valuation Basics By Brian Goodhart Valuation is a fundamental aspect of the complex and intricate world of mergers and acquisitions. Today, we will delve into the intricate art and science of valuation, exploring its various components and purposes.

Focus Investment Banking

JANUARY 18, 2024

The S&P 500 has recently traded near 4800, close to its record at the end of 2021. He advises business owners on sell-side and buy-side transactions, valuation analysis, corporate finance and equity and debt financing. As 2024 starts, the U.S. stock markets are at or near their all-time highs.

Software Equity Group

MARCH 13, 2023

On the surface, things looked rough: the Dow Jones, S&P 500, and the NASDAQ all finished the year with significant losses, with tech stocks hit particularly hard. Median EV/TTM Revenue Multiple Down from 2021’s high of 7.3x, 2022’s median EV/Revenue multiple of 5.6x was only a slight decline from 2020’s 5.7x

Wizenius

JULY 25, 2023

4) Flow: Connect the Statements Create the cash flow statement by linking your Balance Sheet and P&L. Roll forward the Balance Sheet using the P&L and Cash Flow. Thanks, Pratik S Unlock the Secrets of Investment Banking and Financial Modelling - Enroll in Wizenius Investment Banking Course Today!

Wall Street Mojo

JANUARY 15, 2024

Financial Modeling & Valuation Courses Bundle (25+ Hours Video Series) –>> If you want to learn Financial Modeling & Valuation professionally , then do check this Financial Modeling & Valuation Course Bundle ( 25+ hours of video tutorials with step by step McDonald’s Financial Model ).

The TRADE

JUNE 23, 2023

That is the same level as the expected 12-month forward earnings yield across the S&P 500, which has risen by >15% since January. This could shift again the pendulum towards a more defensive positioning in which investors require higher valuation premium to get compensated on risk assets.

Focus Investment Banking

OCTOBER 23, 2023

We know that the formula for valuing high cash-flowing businesses is a multiple applied to profitability, but with lower-margin businesses, it’s likely to be an asset-based valuation comprised of the A/R, inventory and equipment — hopefully with a bump for goodwill. This approach has several advantages: Diversification. Lower costs.

Wizenius

JULY 17, 2023

Financial Statements: Master the concepts of Balance Sheet, P&L, and Cash Flow statement. Thanks, Pratik S Unlock the Secrets of Investment Banking and Financial Modelling - Enroll in Wizenius Investment Banking Course Today! As a BBA graduate or any undergraduate, you have the advantage of time! Aim for a balanced Balance Sheet!

Mergers and Inquisitions

SEPTEMBER 20, 2023

Technical Questions – You could get standard questions about accounting and valuation or VC-specific questions about cap tables, key metrics in your industry, or how to value startups. If you worked at a startup, how did you win more customers or partners in a sales or business development role? Q: Which current startup would you invest in?

Mergers and Inquisitions

MARCH 8, 2023

As the delivery date approaches, the underlying commodity’s price and its futures price converge. The Skills Required for Commodity Trading You do not use traditional financial statement analysis or valuation in commodity trading because the underlying asset is a futures contract , not a stock.

Wizenius

JULY 30, 2023

Follow me/Wizenius for more interesting tricks in financial modelling, investment banking Thanks, Pratik S Unlock the Secrets of Investment Banking and Financial Modelling - Enroll in Wizenius Investment Banking Course Today! They serve you purely for getting design ideas. This will eventually give you speed and confidence.

Wall Street Mojo

JANUARY 15, 2024

read more like P&L and Balance sheet, cash flow statement Cash Flow Statement A Statement of Cash Flow is an accounting document that tracks the incoming and outgoing cash and cash equivalents from a business. The reports reflect a firm’s financial health and performance in a given period. read more , etc. #3

Software Equity Group

NOVEMBER 13, 2023

By aligning your company’s strategies and performance with their evolving priorities, you can enhance your appeal in the competitive landscape of software investments and acquisitions. SaaS companies hoping for a high valuation should aim for 90% or greater gross revenue retention. This creates a baseline for growth.”

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content