Can You Supercharge Your Business Growth? The Roll-Up Strategy REVEALED

How2Exit

NOVEMBER 25, 2024

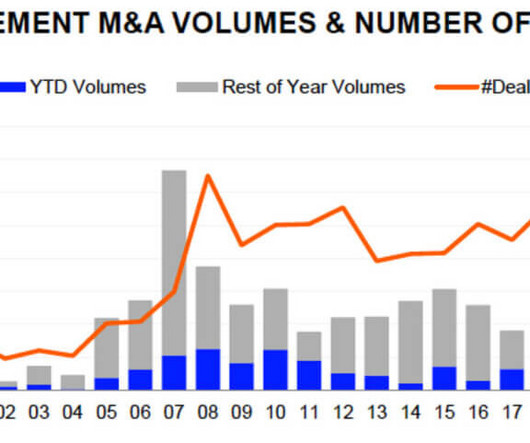

This episode is a goldmine for anyone interested in understanding the intricate strategies that private equity employs to rapidly grow companies through acquisitions. Key Takeaways: Roll-ups serve as a potent strategy for rapid company growth, often offering a de-risked investment decision that private equity firms leverage.

Let's personalize your content