Bank of America downgrades hot IPO and Nvidia derivative CoreWeave, citing valuation

CNBC: Investing

JUNE 16, 2025

" Shares of the AI cloud-computing firm have surged more than 37% so far in June and were about 4% higher on Monday.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

CNBC: Investing

JUNE 14, 2025

" BJ's "We reiterate our Buy rating on BJ, highlighting that we continue to see earnings upside at BJ driven by a better top-line outlook based on continued strong traffic trends, unit volume growth in grocery categories, and greater customer engagement likely in general merchandise categories as a result of the company's assortment (..)

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

CNBC: Investing

JULY 8, 2025

Its initial public offering earlier this year was the biggest technology IPO since 2021. "[W]e'd like to see more customer diversification and progress on profitability." Analysts at Mizuho Securities and Stifel downgraded the artificial intelligence cloud computing stock to hold in the last 24 hours.

CNBC: Investing

JULY 28, 2025

To put that in perspective, 2024 was the company's first profitable fiscal year, reporting $0.79 The trade Currently, the options market is estimating a post-earnings move of approximately 8.5%, which is above the average during the company's history since the IPO and substantially higher than the average move of 5.2%

JD Supra: Mergers

AUGUST 1, 2025

Takeover Panel consultation and new practice statements The Takeover Panel has published a consultation paper on dual class share structures, IPOs and share buybacks. Under the new rules an MTF admission prospectus, which does not need FCA approval, will be required for all IPOs and reverse takeovers on AIM (in new rules MAR 5-A).

CNBC: Investing

JUNE 26, 2025

The company went public to a great deal of fanfare in March of 2021 during the IPO bubble. MELI is on another level than CPNG when it comes to profitability, but CPNG is quickly catching up. Originally, Kim dropped out of Harvard Business School to build a Groupon clone for his native country. Until now. MELI currently earns a 46.7%

CNBC: Investing

JULY 1, 2025

"At current levels — considering the growth trajectory of the business, near-term path to profitability, and below peer valuation — we see OMDA offering compelling risk/reward," Roman wrote in a Monday note to clients. Omada went public in early June, pricing its IPO at $19 per share. That suggests roughly 58.5%

Mergers and Inquisitions

MAY 14, 2025

Like renewable energy IB , different banks classify their groups differently, so you could find yourself working on everything from a data center REIT M&A deal to an airport financing to an IPO for a solar developer. It even includes elements of healthcare , industrials , and oil & gas investment banking.

CNBC: Investing

JUNE 9, 2025

This dual-indication approval not only boosts Alnylam's revenue potential but also strengthens its path toward profitability, making AMVUTTRA a key growth driver for the company and a pivotal reason for recent momentum. And just for fun, below is the "forever" chart back to the company's IPO.

CNBC: Investing

JUNE 16, 2025

"Taken together, we see increased line of sight towards sustainable high-single bottom-line growth, which we believe should help compress the discount to the market multiple," the analyst said. Shares have advanced about 11% so far in 2025.

Global Banking & Finance

OCTOBER 16, 2024

By Tatiana Bautzer, Manya Saini and Niket Nishant (Reuters) – Morgan Stanley’s profit surpassed estimates on a bumper third quarter for investment banking that had also buoyed rivals, sending its stock to a record.

TechCrunch: M&A

MAY 8, 2023

The reason Blinkist hasn’t gone out for funding again in the last five years is because it has’t had to: the company is growing and profitable, and it still has money left in the bank, according to Holger Seim, Blinkist’s CEO and co-founder. Blinkist’s last valuation was $160 million in 2018 , when it raised $18.8

Global Banking & Finance

SEPTEMBER 10, 2024

India’s IPO market is back in action, boasting a 56% rise in listings from 2022 to 2023. The turnaround is a sign of investor confidence returning as economic conditions improve, and startups sharpen their focus on profits.

OfficeHours

OCTOBER 16, 2023

Initial Public Offering (IPO) One way to exit an investment involves taking the company public through an initial public offering (IPO). An IPO involves offering shares of a privately held company to the public in a new stock issuance.

OfficeHours

JUNE 6, 2023

Unlike venture capital, growth equity investments involve companies that are more established and have a track record of generating revenue and profitability. Going public through an IPO is one of the most well-known and potentially lucrative exit strategies for private equity firms.

The TRADE

SEPTEMBER 21, 2023

Aquis reported a 17% increase in its net revenue at £9.7million for the first half of the year, and a profit of 1.1million before tax, up 64% from the previous period. The business also reported overall profit across the other three areas of its business: data, stock exchange, and technologies.

Wall Street Mojo

JANUARY 17, 2024

This differentiation helps identify a company’s profitability Profitability Profitability refers to a company's ability to generate revenue and maximize profit above its expenditure and operational costs. It is measured using specific ratios such as gross profit margin, EBITDA, and net profit margin.

Razorpay

JULY 27, 2023

Investment banking is a branch of banking that organizes and enables large, complex financial transactions for businesses, like mergers, IPOs or underwriting. Investment Banking Services Initial Public Offering (IPO) When a privately-owned business wants to become a publicly traded company, it goes through an IPO , or Initial Public Offering.

How2Exit

OCTOBER 14, 2024

With an extensive career journey that began in Atlanta, Georgia, Rich has been instrumental in transforming small companies to IPO or mergers in record time frames. For a business to be considered valuable, it must offer prospective buyers assurances of future profit sustainability and growth potential.

Wizenius

SEPTEMBER 28, 2024

Private equity funds strive to achieve compelling returns by procuring or investing in companies and actively enhancing their growth and profitability. In the realm of LBOs, exits can materialize through a sale to another entity or via an initial public offering (IPO).

How2Exit

APRIL 8, 2024

rn As the discussion progresses, Wells shares his reflections on being the CEO of a public company post-IPO, the unexpected realities, and the learning curve that has come with the territory. rn rn rn Going public as a company involves facing market dynamics and investor behaviors that may not align with pre-IPO expectations.

Growth Business

JULY 26, 2023

Series C Series C is when start-ups have developed into profitable scale-ups which are looking to expand their operations or venture into a new market. By this stage, companies will have developed a strong market fit, a customer base and require more capital to expand further to prepare themselves for IPO.

Peak Frameworks

MAY 24, 2023

Google, as a C Corporation , pays corporate tax on profits and shareholders pay personal tax on dividends, leading to the 'double taxation' phenomenon. specific entity, where profits pass directly to shareholders and are taxed at personal rates, avoiding 'double taxation'. S Corporations A U.S.-specific is an S Corporation.

The TRADE

FEBRUARY 29, 2024

We are also seeing an encouraging IPO pipeline for the London Stock Exchange. According to the exchange, there has also been good progress on the Microsoft partnership, with the first products expected in H1 2024. “We continue to build the foundations for sustained, profitable growth across all of our businesses.

CNBC: Investing

JUNE 16, 2025

21, Celsius shares popped 25% on strong quarterly earnings results, as well as on acquiring health and wellness company Alani Nu.

Wizenius

JULY 2, 2023

For instance, when a fast-growing e-commerce player like Shopify reaches its peak, an exit via an Initial Public Offering (IPO) can yield substantial profits. 3) Exit Knowing when to make a graceful exit is critical for PE firms to maximize returns.

Focus Investment Banking

FEBRUARY 25, 2024

I still recall the metric that was drilled into me back then: hit $50 million in revenue and a few back-to-back years of profitability and you, too, can go public. First, there’s the ability to raise substantial capital by issuing shares to the public in an initial public offering (IPO), as well as secondary offerings.

Growth Business

JULY 17, 2024

Instead, investors become partial owners of the business and share in its profits and losses. Private equity companies are perhaps the clearest examples of this type of financing, and you can also count here sources such as crowdfunding , IPOs, and incubators and accelerators. Then the partnership might succeed.

Peak Frameworks

OCTOBER 30, 2023

The profit-making strategies differ across these banks. Subtracting the $50 paid to you, the bank makes a net profit of $350. This increased activity translates to more commissions for banks and potentially higher profits from proprietary trading. Investment Banks: Institutions like Goldman Sachs and J.P.

Global Newswire by Notified: M&A

OCTOBER 20, 2024

euros per share, up 40% from its initial IPO price of 6.00 The net profit for the first half of 2024 was 199,164 euros. Virtualware has been listed on Euronext Paris since April 2023 under the ticker MLVIR. The company's current market capitalization exceeds 38 million euros, and its share price currently stands at 8.40

Software Equity Group

SEPTEMBER 17, 2024

C Corp for Software Companies Factor Impact Investor Appeal Tax Efficiency Ownership Flexibility M&A Potential C Corps are highly attractive to investors, particularly for those considering venture capital or IPO. LLCs provide pass-through taxation, where profits and losses are reported on the owners' personal tax returns.

The Deal

AUGUST 9, 2023

M&A is a central part of SymphonyAI’s growth strategy as the company prepares for a potential private placement and, eventually, an IPO. “We’re Profitable Growth SymphonyAI , which became profitable in the first quarter, aims to be the No. AI), which is not profitable, has a $4.4

Mergers and Inquisitions

JANUARY 24, 2024

They invest when companies already have revenue (like PE firms), but they do so by purchasing minority stakes , holding them, and selling in an IPO or M&A exit (like VC firms). For reference, the case document said to expect profitability by the end of the 5 years.

Sun Acquisitions

SEPTEMBER 16, 2024

Enhance your business’s attractiveness to potential buyers by focusing on key value drivers such as revenue growth, profitability, customer retention, intellectual property, and operational efficiency. Maximize Business Value: One of the primary objectives of an exit strategy is to maximize the value of your business.

Mergers and Inquisitions

MARCH 13, 2024

This style is about purchasing minority stakes in cash-flow-negative-but-high-growth companies that want to scale and eventually go public or sell (think: Uber or Airbnb before their IPOs). Most companies are already profitable, the potential returns are lower, and there’s usually a large secondary component (i.e.,

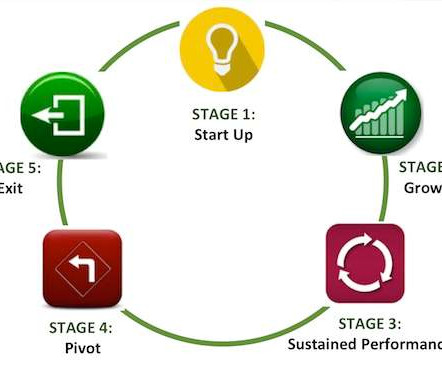

Peak Frameworks

SEPTEMBER 19, 2023

Businesses typically don't generate a profit at this point, making external financing necessary. The enterprise expands, market share increases, and profits start to accumulate. Choosing the right exit strategy—be it acquisition, Initial Public Offering (IPO), or management buyout—is critical.

Growth Business

JULY 11, 2023

They chase turnover or focus on profits, but unless you’ve got cash your business isn’t going to survive.’ 3) Aquis Stock Exchange Aquis Stock Exchange , run by NEX, allows businesses to raise capital through Initial Public Offerings (IPOs). >See If the answer is yes, it may be worth exploring the idea of expansion capital.

Razorpay

AUGUST 9, 2023

Underwriting Services Merchant banks also provide underwriting services for initial public offerings (IPOs), private placements, follow-on public offerings (FPOs) and rights issues. Leasing Services Merchant banks provide leasing services to companies in the form of capital goods, vehicles and office equipment.

Devensoft

AUGUST 21, 2023

Their goal is to identify underperforming companies, acquire them, and implement strategic changes that drive efficiency and profitability. These firms have a proven track record of successfully transforming underperforming companies into highly profitable entities. Another case study is the acquisition of Dell by Silver Lake Partners.

Razorpay

JUNE 8, 2023

Corporate Finance Management Special kinds of banks called investment banks help businesses with complex financial transactions like mergers and acquisitions or IPOs. Businesses take loans to expand operations, meet liquidity needs, or fund daily operations. This is how banks make money – by loaning out the money that people have deposited.

Cooley M&A

JANUARY 25, 2023

Although there were 104 initial public offerings of biotechnology companies in 2021 that raised nearly $15 billion in funds, 2022 saw only 22 such IPOs collectively raising less than $2 billion. Let’s dig in.

Mergers and Inquisitions

MAY 24, 2023

Event-Driven Hedge Funds Definition: Event-driven hedge funds bet on specific corporate actions, such as M&A deals, divestitures, spin-offs, bankruptcies, and business reorganizations, and they profit based on changes in the value of a company’s debt or equity after the action. EBITDA multiple , matching its own.

The TRADE

MAY 30, 2024

An additional three times multiplier is also added if the venue has had an IPO in the last three years in a bid to encourage more listings. Extra credit is also awarded to bigger venues for any recent IPOs. This in itself is something to be considered for those that might look to throw their hat into the ring to host it.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content