Can You Supercharge Your Business Growth? The Roll-Up Strategy REVEALED

How2Exit

NOVEMBER 25, 2024

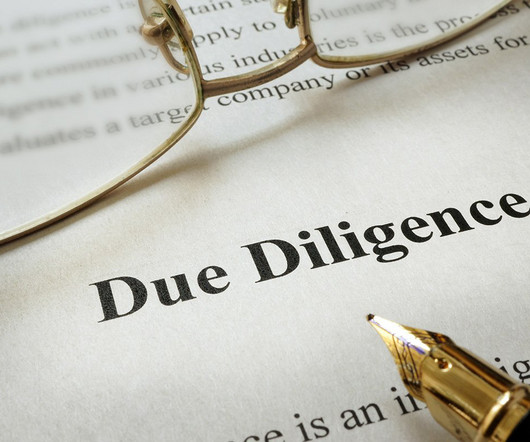

Integrating talent and aligning interests across multiple acquisitions magnifies operational efficiencies, improving prospectives for valuation bumps. Developing a compelling roll-up narrative to assure investors on return potentials is key, whether one is a seasoned CEO or a novice operator.

Let's personalize your content