Best Practices for Due Diligence and Valuation in M&A

Sun Acquisitions

JUNE 27, 2025

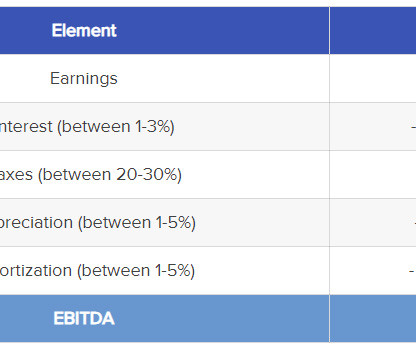

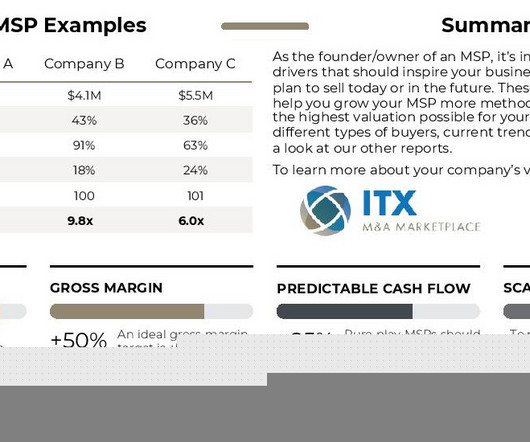

Due diligence and valuation are critical to any successful merger and acquisition (M&A) deal. Businesses can make informed decisions and mitigate risks by conducting thorough due diligence and accurately valuing a target company. It helps to uncover potential risks and opportunities, allowing buyers to make informed decisions.

Let's personalize your content