Blockchain-based Canton Network connects to Nasdaq Calypso

The TRADE

JUNE 26, 2025

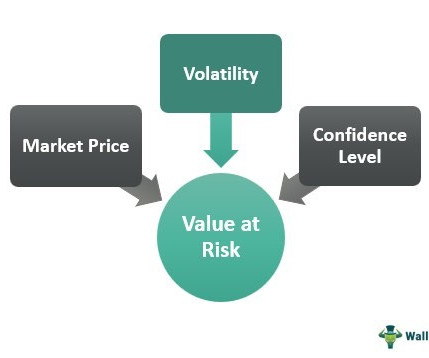

Financial institutions need to improve real time risk management and mobilise collateral to optimse capital and liquidity deployment. Nasdaq Calypso allows financial institutions to manage risk, margin, and collateral needs in an integrated environment.

Let's personalize your content