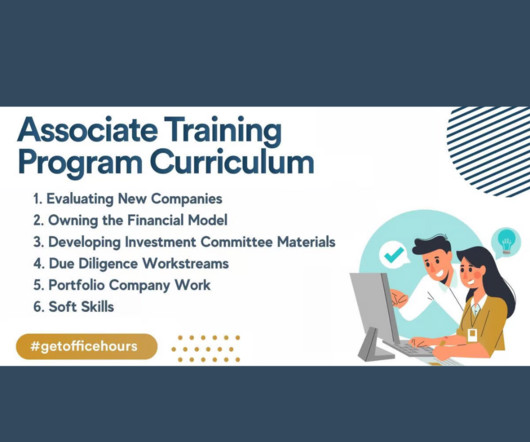

How the Private Equity Associate Course Drives Better Deal Execution

OfficeHours

JUNE 5, 2023

Private equity firms play a vital role in the broader investment landscape, and their success relies heavily on their ability to execute deals effectively. Enhanced Financial Modeling Skills Financial modeling is a CRITICAL aspect of deal execution.

Let's personalize your content