Judge Blocks JetBlue From Acquiring Spirit Airlines

The New York Times: Mergers, Acquisitions and Dive

JANUARY 16, 2024

The ruling is a victory for the Justice Department, which had argued that the merger would reduce competition.

The New York Times: Mergers, Acquisitions and Dive

JANUARY 16, 2024

The ruling is a victory for the Justice Department, which had argued that the merger would reduce competition.

TechCrunch: M&A

JANUARY 16, 2024

London-based notetaking startup Goodnotes said today it is acquiring South Korean startup Dropthebit, which operates a meeting and video summary tool called Traw. With the acquisition, Goodnotes is looking to move beyond classrooms and explore making productivity tools for professionals. As part of the deal, all three co-founders of Dropthebit will move to Goodnotes.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

JD Supra: Mergers

JANUARY 17, 2024

California’s new Office of Health Care Affordability recently adopted emergency regulations (“Final Regulations”) implementing the Health Care Market Oversight Program, required under California’s Health Care Quality and Affordability Act (“HCQAA”). HCQAA, which created the Office of Health Care Affordability (“OHCA”), requires “health care entities” to provide written notice of certain “material change transactions” to OHCA.

H. Friedman Search

JANUARY 18, 2024

Do you want to be where you were at the end of 2023 at the conclusion of 2024? So many people decide to kick the tires at their current company but don’t do anything more than that for various reasons. In this blog, I want to examine the reason people do not move forward when they know they need to deep down in their hearts. It’s because people let their emotions overrule their business decisions.

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

The New York Times: Banking

JANUARY 19, 2024

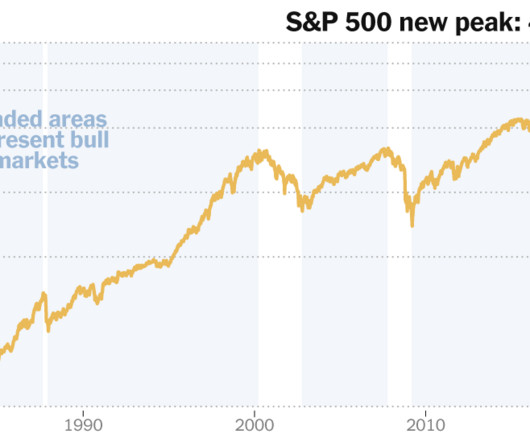

The S&P 500 crossed above its January 2022 peak after weeks of wavering. Investors have been buying stocks after homing in on signals that the Fed’s campaign of raising interest rates is over.

TechCrunch: M&A

JANUARY 13, 2024

M&A is expected to rise in 2024, but we won't likely see a lot of consolidation among startups that wouldn't make it on their own. © 2023 TechCrunch. All rights reserved. For personal use only.

Investment Banking Today brings together the best content for investment banking professionals from the widest variety of industry thought leaders.

The New York Times: Mergers, Acquisitions and Dive

JANUARY 19, 2024

The company’s owner has been plunged into a maelstrom in recent weeks as its senior executives have been forced out.

CNBC: Investing

JANUARY 19, 2024

If history is any indication, stocks could be in for even bigger gains ahead.

TechCrunch: M&A

JANUARY 17, 2024

ZestMoney, the Goldman Sachs-backed Indian fintech startup once valued at $450 million, has sold itself to financial services firm DMI Group, the two said late Wednesday, in a fire sale that caps 12 tumultuous months for the once-hot new-age lender. The two firms didn’t disclose the terms of the deals, but a person familiar with […] © 2023 TechCrunch.

JD Supra: Mergers

JANUARY 19, 2024

Canada’s Competition Act was amended effective December 15, 2023 to both (i) establish a new, more expansive framework for challenging anti-competitive conduct by dominant firms and (ii) specifically provide that it is an anti-competitive act for a dominant firm to directly or indirectly impose excessive and unfair selling prices.

Speaker: Brian Muse-McKenney, Chief Revenue Officer & Matt Simester, Cards and Payments Expert

In today’s world of social media, dating apps, and remote work, businesses risk becoming irrelevant (or getting "ghosted") if they fail to meet the evolving needs of Gen Z consumers. Credit cards with flexible payment options, especially for young adults with little-to-no credit history, are a particularly important and valuable solution for this generation.

The New York Times: Banking

JANUARY 16, 2024

Gross domestic product expanded 5.2 percent, as China worked to export more to make up for weak demand, high debt and a steep property contraction at home.

OfficeHours

JANUARY 15, 2024

Let’s be honest, 2023 went by in a flash and it wasn’t the most exciting year in the market. Deal activity was not as robust as prior years and the number of deals that made it to the finish line were few and far between. As a result, the job market has also been rather slow which gave us time to reflect and focus on preparing for 2024. And the good news is: All signs are pointing to recruiting picking up in the first quarter of 2024!

TechCrunch: M&A

JANUARY 16, 2024

Snyk, the well-funded developer-focused security company, today announced that it has acquired Helios, a Tel Aviv-based startup that helps developers troubleshoot and understand their microservices in production. Snyk will use Helios to bolster its recently launched AppRisk service, its application security play, and to provide them with a better overall security service both at build […] © 2023 TechCrunch.

JD Supra: Mergers

JANUARY 17, 2024

Spotlight on Financial Services | Clients depend on Dinsmore to offer clear and concise counsel in the complex area of financial services Columbus-based corporate partner Christian Gonzalez explains how our team’s multidisciplinary approach can meet the most complex demands, and offer training for those new to the financial services industry.

Speaker: Robbie Bhathal, Founder & CEO, and Matthew Acalin, Head of Credit Intelligence

In today's volatile financial environment, how confident are you in your company’s financial forecasting? To get the most accurate cash predictions that will lead to long-term financial survival, real-time data is critical. Innovative cash management strategies can lead to better credit opportunities, more sustainable growth, and long-term financial prosperity.

The New York Times: Banking

JANUARY 18, 2024

In a country of fewer than 400,000, finding places for 3,700 residents is complicated by a tough housing market.

How2Exit

JANUARY 13, 2024

b' E176: Guest Host Marty Fahncke Asked Ronald to Share His Top Insights On Buying & Selling Businesses - Watch Here rn rn About the Guest Host: Marty Fahncke , founder of Westbound Road, LLC , an e-mergers and acquisitions advisor and author, has been helping businesses scale to over a billion in revenue and executing over 450 million in mergers and acquisitions.

Deal Lawyers

JANUARY 18, 2024

Organized labor has scored some impressive victories in the past year, and unions’ increasing leverage in collective bargaining and enhanced organizing efforts have complicated the labor due diligence picture for prospective buyers in M&A transaction. This excerpt from a recent LegalDive.

JD Supra: Mergers

JANUARY 15, 2024

For companies in the energy and chemical sectors, the potential for antitrust scrutiny is an ever-present concern. The next round of enforcement inquiries is never further away than the next jump in commodity prices or the next consolidation wave. Especially under an enforcement-minded administration, companies should stay focused on timely transaction planning and routine compliance efforts to manage their antitrust-related risks.

Advertisement

The complexity of financial data, the need for real-time insight, and the demand for user-friendly visualizations can seem daunting when it comes to analytics - but there is an easier way. With Logi Symphony, we aim to turn these challenges into opportunities. Our platform empowers you to seamlessly integrate advanced data analytics, generative AI, data visualization, and pixel-perfect reporting into your applications, transforming raw data into actionable insights.

The New York Times: Banking

JANUARY 17, 2024

The options would include charging a benchmark fee, set by the bureau, that would be significantly lower than the current $35 standard.

How2Exit

JANUARY 13, 2024

b' E177: Serial Founder Max Koutny Shares His Entrepreneurial Journey and Acquisition Criteria - Watch Here rn rn About The Guest(s): Max Koutny is a serial entrepreneur and founder of multiple companies. He has experience in various industries, including architecture, specialty products, health and wellness, and organic skincare. Max is currently searching for new acquisition opportunities in the health and wellness, personal care and beauty, food and beverage, specialty chemicals, and alternat

Deal Lawyers

JANUARY 16, 2024

In City of Hialeah Employees Retirement System v. Insight Venture Partners, (Del. Ch.; 12/23), the Chancery Court rejected breach of fiduciary duty allegations against the directors of an acquiring company and its purported controlling stockholder arising out of the buyer’s purchase of the controller’s portfolio company.

JD Supra: Mergers

JANUARY 18, 2024

Illumina Agrees to Unwind Acquisition of Grail Following Fifth Circuit Decision. On December 15, 2023, the Fifth Circuit vacated the FTC’s order that Illumina unwind its acquisition of Grail—a developer of a multi-cancer early detection (MCED) test.

Advertisement

In the fast-moving manufacturing sector, delivering mission-critical data insights to empower your end users or customers can be a challenge. Traditional BI tools can be cumbersome and difficult to integrate - but it doesn't have to be this way. Logi Symphony offers a powerful and user-friendly solution, allowing you to seamlessly embed self-service analytics, generative AI, data visualization, and pixel-perfect reporting directly into your applications.

The New York Times: Banking

JANUARY 16, 2024

Christopher Waller, one of seven Washington-based Fed governors, said officials should cut rates as inflation cools — though timing was uncertain.

How2Exit

JANUARY 13, 2024

b' E178: Building and Monetizing Websites: Insights from a Website Flipper, Marc Andre - Watch Here rn rn About the Guest(s): rn Marc Andre is a seasoned entrepreneur and online business expert who entered the world of website creation and monetization back in 2007. With a background as an auditor for a finance company, he shifted his focus to developing websites and creating digital products that cater to various industries, including web and graphic design, photography, and personal finance.

CNBC: Investing

JANUARY 19, 2024

The S&P 500 sits within swinging distance of its all-time high from January 2022.

JD Supra: Mergers

JANUARY 16, 2024

On 28 December 2023, the French government adopted decree number 2023-1293 (Decree), together with an administrative order of the same date (Order), that expanded the scope of covered investments and covered activities under French foreign direct investment (FDI) rules (as amended, the New Rules).

Advertisement

In the rapidly evolving healthcare industry, delivering data insights to end users or customers can be a significant challenge for product managers, product owners, and application team developers. The complexity of healthcare data, the need for real-time analytics, and the demand for user-friendly interfaces can often seem overwhelming. But with Logi Symphony, these challenges become opportunities.

The New York Times: Banking

JANUARY 18, 2024

Federal regulators want to raise capital requirements for big banks. Their plan is drawing criticism from groups that aren’t normally aligned with the industry.

The New York Times: Mergers, Acquisitions and Dive

JANUARY 16, 2024

The deal was the latest sign of changes in the tech sector, as artificial intelligence booms and sales of some hardware slows.

CNBC: Investing

JANUARY 16, 2024

Coming off a wonderfully surprising stock market global boom of 2023, this year could be anybody's guess.

JD Supra: Mergers

JANUARY 15, 2024

In 2023, cartel fines in key jurisdictions increased by 7.7%—totaling $1.4 billion—compared to 2022. While the totals remain significantly below the peaks seen in the mid-2010s, 2023 saw record fines imposed in several jurisdictions (Japan, United States, Australia, and Canada), which demonstrates global competition enforcers’ continuing intent to pursue cartels and impose severe sanctions.

Advertisement

Generative AI is upending the way product developers & end-users alike are interacting with data. Despite the potential of AI, many are left with questions about the future of product development: How will AI impact my business and contribute to its success? What can product managers and developers expect in the future with the widespread adoption of AI?

Let's personalize your content