M&A in the Digital Age: How Tech is Supercharging Dealmaking

Sun Acquisitions

NOVEMBER 26, 2024

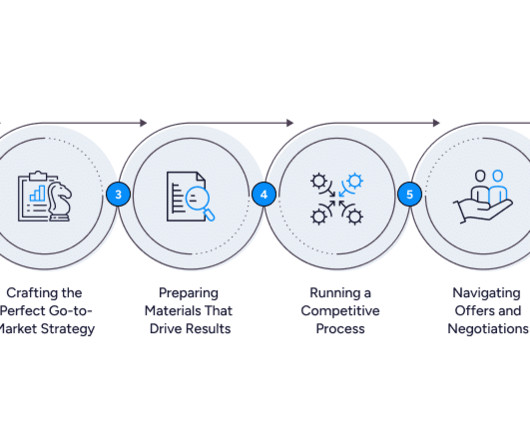

Mergers and acquisitions (M&A) have always been a high-stakes game. From streamlining complex processes to uncovering hidden opportunities, tech supercharges M&A dealmaking across all stages. Virtual data rooms (VDRs) and AI-powered document review tools have revolutionized the game.

Let's personalize your content