A Sharper Focus: Exploring VC Side Letters

JD Supra: Mergers

JANUARY 22, 2025

By: Troutman Pepper Locke

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

JD Supra: Mergers

JANUARY 22, 2025

By: Troutman Pepper Locke

JD Supra: Mergers

MAY 22, 2024

Whether, as part of the management of your startup, you are tasked with driving an equity or debt financing to closing or with gearing up for an exit event, disclosure schedules will be one of the many documents that you will negotiate and deliver as part of your deal.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Sun Acquisitions

MARCH 8, 2022

One of the first questions a seller often asks is, “What documents are needed to sell a business?”. We’ve split the required documents as follows: A checklist of the legal documents needed to sell a business. A checklist of the financial documents needed to sell a business. Legal Documents Needed to Sell a Business.

The M&A Lawyer

AUGUST 23, 2015

Core competencies include: strategic thinking, negotiation, multitasking, delegation, organization, complex drafting, attention to detail and. She may be an in-house attorney but is more often an M&A specialist practicing with an outside law firm. In many respects, an M&A lawyer is a legal jack of all trades.

Global Banking & Finance

SEPTEMBER 6, 2024

By Kate Abnett BRUSSELS (Reuters) – European Union countries are considering delaying the introduction of EU-wide taxes on polluting aviation fuels for 20 years, as they seek a breakthrough on tax reforms that have been negotiated for years with little progress, a draft document seen by Reuters showed.

Devensoft

JUNE 13, 2023

Purchasing a business is a significant decision that requires careful planning and negotiation. One of the most critical steps in the acquisition process is negotiating the letter of intent (LOI). A letter of intent is a document that outlines the basic terms and conditions of a proposed transaction between a buyer and a seller.

Sun Acquisitions

JULY 10, 2023

To achieve this, there are several key negotiation points you will need to consider in the process. This post will explore key negotiation points that will help you navigate the sales process and achieve the best outcome. Valuation One of the key negotiation points you should consider when selling your business is the valuation.

Sun Acquisitions

OCTOBER 21, 2024

In the dynamic world of mergers and acquisitions (M&A), financing plays a pivotal role in bringing deals to fruition. For mid-sized businesses eyeing growth opportunities through M&A, understanding the available financing options is essential for success.

Software Equity Group

SEPTEMBER 24, 2024

A term sheet is often used in the early stages of negotiating a venture capital investment or M&A transaction. Since SEG often helps facilitate term sheet discussions, we’ll also share some practical guidance on how to negotiate them and a term sheet template to show you what they look like. What is a Term Sheet?

How2Exit

FEBRUARY 23, 2023

It is also important to be proactive and persistent in the negotiation process. Effective negotiation is an important skill for any entrepreneur and can be especially valuable in the process of acquiring a business. Negotiating with empathy is an important part of successful negotiation.

Sun Acquisitions

FEBRUARY 20, 2024

Seller financing can be an attractive option for acquiring a business or real estate property. This blog post will explore the critical aspects of due diligence in seller financing deals and what buyers must know to ensure a successful transaction. It offers flexibility in structuring the deal and potentially lower upfront costs.

Midaxo

APRIL 25, 2023

What would be good an outline for a document defining our M&A objectives? How to outline the process for negotiating deal terms and determining valuation? It provides a strategic roadmap for identifying, evaluating, negotiating, and integrating potential M&A transactions. How to develop an acquisition strategy?

Wizenius

JUNE 21, 2023

In the exciting world of renewable energy, financing projects can be challenging when operating in a country with uncertain regulatory frameworks. However, with careful planning and a solid strategy, it's possible to structure a project finance deal that attracts investors and mitigates risks. Consider the following elements: a.

How2Exit

MARCH 21, 2023

This process involves researching the business’s financials, legal documents, and other relevant information. Another important part of due diligence is researching the legal documents associated with the business. This includes contracts, leases, and other documents that are relevant to the business.

How2Exit

MARCH 1, 2023

Joel believes that a lot of the stuff that people uncover during the negotiation process should have been known before the negotiations process. In addition to understanding the process and managing the professionals, it is important to have an attorney review the documents before they are sent out.

Lake Country Advisors

FEBRUARY 16, 2024

Asset valuation plays a pivotal role in determining the overall worth of a business, influencing potential buyers’ decisions and negotiations. Clear and organized financial documentation not only speeds up the selling process, but also gives potential purchasers confidence. This ensures a smoother negotiation process.

Growth Business

OCTOBER 2, 2023

Fuelled by a spike in high-profile breaches over the last few years, numerous businesses have set up to provide solutions for thwarting cybercrime and combat the increasingly prevalent risks of fraud, money laundering and terrorist financing activities. This is not just a legal necessity.

Cooley M&A

SEPTEMBER 25, 2020

The decisions from the court on those preliminary matters, as well as the arguments raised by legal counsel, offer some valuable lessons for sellers considering sale transactions that require debt financing, and may motivate sellers to re-evaluate certain provisions and remedies that have become customary in those transactions.

Razorpay

OCTOBER 8, 2024

A proforma invoice is a preliminary or initial document issued by a seller to a prospective buyer before a sale is completed. These invoices offer buyers a clear view of the proposed transaction conditions and allow for negotiations before closing the deal. This promotes healthy connections and seamless interactions.

How2Exit

SEPTEMBER 15, 2024

Beginning his journey at the young age of 22, Ray has carved a niche for himself in the small business financing sector, emphasizing SBA 7(a) loans. Throughout his career, he has facilitated millions in financing for small business acquisitions. So my whole career has been all about small business financing." I'm 35 now.

How2Exit

MARCH 24, 2023

Through his experience, he learned the power of leveraged buyouts and how they could be used to finance acquisitions. They can help them with things such as accounting, profit and loss statements, and other financial documents. Seller financing is the most favorable option, as it comes with the least restrictions.

Lake Country Advisors

AUGUST 7, 2023

For example, low-interest rates can make financing more accessible for buyers, potentially increasing your business’s pool of interested parties. Negotiating the Sale Once potential buyers have expressed interest, the negotiation phase begins. Non-compliance can lead to legal penalties or invalidation of the sale.

Wizenius

MAY 4, 2023

As a finance student, you'll likely come across the term "term sheet" when studying investment banking and finance. In investment banking, a term sheet is a non-binding document that outlines the basic terms and conditions of an investment or financing deal between two parties. What is a Term Sheet?

Lake Country Advisors

OCTOBER 17, 2024

Proper preparation involves organizing your finances, optimizing operations, and presenting your business in the best possible light to attract potential buyers. Organized financial documents will expedite the sale process and position you as a serious seller ready for due diligence.

The M&A Lawyer

AUGUST 31, 2015

APAs provide for use of legal instruments necessary to transfer ownership, such as bills of sale (for personal property), assignment and assumption agreements (for contracts and permits), intellectual property assignments, real property transfer documents and so on. seller cooperation with financing. authority and enforceability.

M&A Leadership Council

OCTOBER 2, 2023

Document check: The parties will recheck all the documents against the closing checklists. In the case of a transaction involving third-party financing, what part of the deal closes first? In theory, all transactions typically are deemed to take place simultaneously. How long does it actually take to close a transaction?

How2Exit

JUNE 26, 2023

Wendy's own experience with selling her business, Document Warehouse, illustrates the importance of choosing a target acquirer. This means keeping detailed records and documents, updating them regularly, and making sure that everything is in order. In fact, many don't even know what it is.

How2Exit

MAY 8, 2023

Once the evaluation is complete, the buyer and seller must then negotiate the terms of the transaction. This negotiation process can be complex and may involve the use of lawyers, accountants, and other professionals. This paperwork will include the purchase agreement, the transfer of ownership documents, and the closing documents.

Lake Country Advisors

DECEMBER 5, 2024

Financial Statements Start with a thorough review of financial documents. Cash Flow Reports : Examine cash flow to understand how effectively your business manages its finances. Maintaining well-documented and error-free financial records boosts your credibility and supports a smooth valuation process.

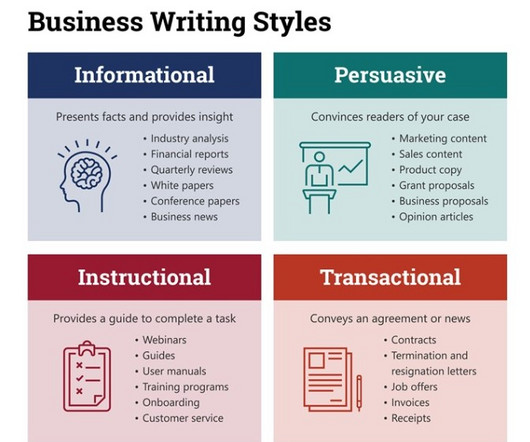

Peak Frameworks

AUGUST 15, 2023

Organization and Structure A well-structured document makes it easier for the reader to follow your points. This is particularly important in lengthy documents like annual reports. Types of Business Writing in Finance Memos and Emails These are usually short, direct, and often action-oriented. Incorporating data is also key.

Focus Investment Banking

OCTOBER 7, 2024

Updates to this second edition include quality of earnings reports, representation and warranty insurance, how to hire investment bankers, changes to the offering documents, the rise of family offices, and the ubiquity of adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) as a basis for valuation.

How2Exit

JULY 3, 2023

Kirk Michie, with his three decades of experience in finance and business advisory, has honed his expertise in mergers and acquisitions, making him well-suited to assist entrepreneurs in navigating these transactions. However, this can backfire if the information is used against them during the negotiation process.

Sun Acquisitions

APRIL 17, 2023

Regarding streamlining operations, looking at all aspects of your business — from customer service to finance — and evaluating which areas can be improved upon or made more efficient is essential. This could sometimes mean updating outdated systems or processes or hiring new personnel with specialized skills.

IBG

APRIL 4, 2023

In a business sale, the letter of intent is a vital document, and sellers need to thoroughly understand its purpose and scope. The moral is this: In a business sale, the letter of intent is a very important document, and both parties need to understand its purpose and scope and take it seriously. What is a “letter of intent”?

The M&A Lawyer

AUGUST 25, 2015

Some, such as “Liabilities,” “Material Adverse Effect” or “Seller’s Knowledge” (or their equivalents) are used throughout the contract and may be the subject of extensive negotiations. Article 3: Seller Representations and Warranties. authority and enforceability. absence of conflicts.

Viking Mergers & Acquisitions

MAY 25, 2023

Your broker will review your company’s financial documents, market forecasts for your sector, and other items to provide an overall picture of your company’s health and profitability. Much of our success lies in negotiation and in identifying buyers who are a good match for a business.

The M&A Lawyer

SEPTEMBER 8, 2015

A substantial amount of the time and energy involved in papering and negotiating the deal is usually devoted to reps and warranties. Parties are well-served to remember this risk-shifting function during negotiations. Why do representations and warranties get so much attention? Reps serve four primary functions. Disclosure. guarantees.

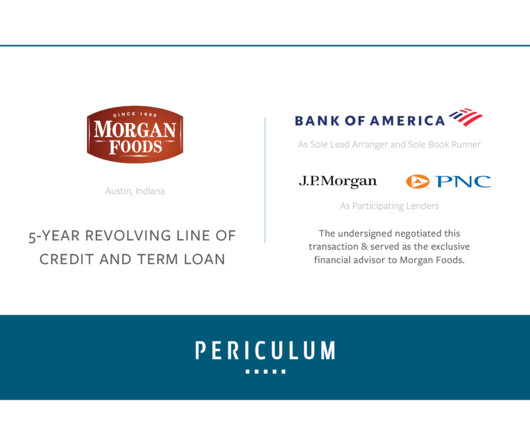

Periculum Capital

MARCH 12, 2022

In addition to designing the customized debt placement solicitation process, Periculum assisted Morgan with information preparation, outreach to and ongoing communication with prospective lenders, negotiation of term sheets, documentation and the closing.

Razorpay

OCTOBER 7, 2024

While both documents serve crucial roles in the business process, they have distinct purposes and uses. A document provided by an agent or consignee that outlines the actual sales made on behalf of the seller. Use Cases Used for offering quotations, preliminary negotiations, or to request advance payments.

Lake Country Advisors

MARCH 21, 2024

Develop Strategies to Mitigate Risks: Create plans to address IP risks, such as negotiating settlements or resolving disputes. Document Decisions and Communications: Maintain thorough documentation of all decisions related to employee relations during the merger.

Razorpay

AUGUST 21, 2024

In the realm of global commerce, invoices serve as the fundamental documents facilitating financial communication and accountability between parties. A proforma invoice is a preliminary, non-binding document that a seller sends to a buyer before a sale is finalized. Final document issued after goods/services have been delivered.

Razorpay

DECEMBER 15, 2024

A letter of credit is a financial document issued by a bank or financial institution that guarantees payment to a seller on behalf of the buyer, as long as specific conditions outlined in the document are met. Finally, the buyer receives the shipment along with the necessary documents to claim the goods, completing the transaction.

Focus Investment Banking

SEPTEMBER 3, 2024

The teaser is a two-page document that is intended to get a buyer to want to learn more, which they can do after signing a confidentiality agreement. Upon gathering the LOIs, with our guidance, the client decides which buyers we are going to negotiate with to find the ultimate buyer with the most acceptable LOI.

Sun Acquisitions

JUNE 15, 2022

Business valuation, according to the Corporate Finance Institute , is the “process of determining the present value of a company or an asset.”. This in turn allows you to price correctly, negotiate confidently, and settle on a just amount. Step #2 Prepare all relevant documents. How much is your business worth?

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content