A Sharper Focus: Exploring VC Side Letters

JD Supra: Mergers

JANUARY 22, 2025

By: Troutman Pepper Locke

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

JD Supra: Mergers

JANUARY 22, 2025

By: Troutman Pepper Locke

JD Supra: Mergers

MAY 22, 2024

Whether, as part of the management of your startup, you are tasked with driving an equity or debt financing to closing or with gearing up for an exit event, disclosure schedules will be one of the many documents that you will negotiate and deliver as part of your deal.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

iMerge Advisors

APRIL 15, 2025

Summary of: What Privacy, Security, and Compliance Documentation Will Acquirers Expect? In this article, well outline the key privacy, security, and compliance documentation that buyers especially private equity firms and strategic acquirers expect to see during due diligence.

Mergers and Inquisitions

JANUARY 24, 2024

Let’s start with the elephant in the room: yes, we’ve covered the growth equity case study before, but I’m doing it again because I don’t think the previous examples were great. So, you can think of this example and tutorial as “Growth Equity Case Study: The Final Form.” They over-complicated the financial model (e.g.,

Software Equity Group

SEPTEMBER 24, 2024

A term sheet is often used in the early stages of negotiating a venture capital investment or M&A transaction. Since SEG often helps facilitate term sheet discussions, we’ll also share some practical guidance on how to negotiate them and a term sheet template to show you what they look like. What is a Term Sheet?

Focus Investment Banking

FEBRUARY 4, 2025

Financial Buyers : These are typically investment companies, such as private equity firms, with no prior investment in your industry. Sometimes strategic buyers are backed by private equity, focusing on both organic growth and acquisitions. What are the key terms I should negotiate in a sale or investment deal?

How2Exit

FEBRUARY 23, 2023

It is also important to be proactive and persistent in the negotiation process. Effective negotiation is an important skill for any entrepreneur and can be especially valuable in the process of acquiring a business. Negotiating with empathy is an important part of successful negotiation.

How2Exit

APRIL 4, 2023

This is especially true for larger transactions, such as those involving private equity. Private equity firms get their money from investors, and when interest rates are high, they have to lower the multiple they pay in order to get the same return they did when interest rates were lower.

Sun Acquisitions

JANUARY 8, 2025

This is music to the ears of strategic acquirers and private equity firms. Sellers should also streamline all operations and document standard operating procedures. Private equity buyers who are after targets with stable cash flows and growth potential. Negotiating the Best Deal Structure Its not just about the sale price.

Lake Country Advisors

MAY 9, 2025

A clear sense of your company’s market position shapes your negotiation tactics and marketing campaigns since buyers typically seek stable revenue, consistent profits, and a clear growth strategy. Whether your firm fits in this category can affect how you approach potential buyers, from strategic acquirers to private equity groups.

Sun Acquisitions

SEPTEMBER 9, 2022

If it makes financial sense and you understand the dilution aspect of selling equity and the potential interference from investors, then yes, go ahead. In this post, we’re going to address what these are, some of the challenges to expect, how to sell the equity, and who to sell it to. Selling equity – the good, the bad, the ugly.

Growth Business

MARCH 1, 2024

By Dom Walbanke on Growth Business - Your gateway to entrepreneurial success Raising private equity funds is seen as the holy grail for businesses who want to grow quickly, simply because the strength of capital opens the door for rapid growth.

Software Equity Group

MARCH 18, 2024

The journey can be arduous, from grappling with due diligence, negotiation intricacies, and legal hurdles to managing customer relationships concurrently, driving revenue growth, and fostering innovation. Understanding their preferences and priorities significantly contributes to our ability to negotiate successfully.

Lake Country Advisors

OCTOBER 31, 2024

A local business broker can be invaluable in identifying opportunities, assessing the business’s financial health, and negotiating on your behalf to ensure a smooth transaction. Negotiating Partnership Terms Negotiating partnership terms is a critical step that prevents future misunderstandings.

How2Exit

MARCH 24, 2023

They can help them with things such as accounting, profit and loss statements, and other financial documents. Concept 3: Equity in Exchange For Value Equity in exchange for value is a concept that has become increasingly popular in recent years.

Cleary M&A and Corporate Governance Watch

JUNE 5, 2023

9] Sellers claimed that this arrangement did not entitle Marquez to any equity interest in the subsidiary and instead provided Marquez with “something akin to a distribution right or contingent value right,” [10] whereas buyer claimed that this arrangement granted Marquez an equity interest in the relevant subsidiary. [11]

Sun Acquisitions

SEPTEMBER 16, 2024

Document Processes and Systems: Documenting your business’s processes, systems, and intellectual property is essential for a smooth transition during an exit. Create comprehensive operational manuals, employee handbooks, and proprietary technology documentation to ensure the continuity and transferability of critical assets.

iMerge Advisors

APRIL 14, 2025

But in nearly all cases, the quality and clarity of your financial documentation will directly impact valuation, deal structure, and buyer confidence. Buyers whether strategic acquirers or private equity firms will typically expect at least GAAP-compliant financials. What Financial Documentation Are You Overlooking?

iMerge Advisors

APRIL 14, 2025

Even after months of diligence, negotiation, and documentation, the final 5% of the deal often requires 50% of the effort. At iMerge, weve advised on hundreds of software and technology transactions, and weve seen firsthand how last-minute negotiations can either derail a deal or solidify a successful exit.

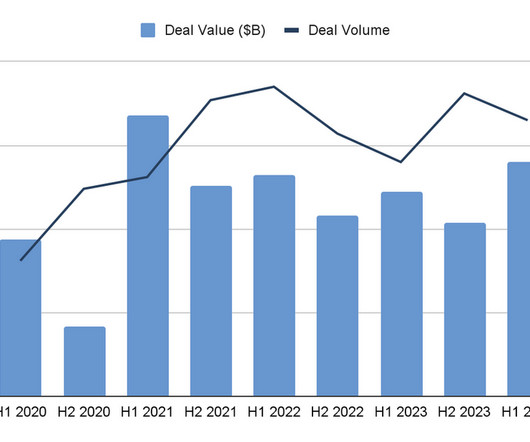

Software Equity Group

MARCH 26, 2024

For top private equity firms, there’s a lot to like about SaaS. Top Software Private Equity Firms Here is a select list of the most active PE investors in the SaaS and software industry over the past year (data taken from the SEG 2024 Annual SaaS Report ). The firm employs 93 professionals.

How2Exit

MAY 15, 2023

I also wanted to outsource the labor-intensive pieces of the job, such as the diligence and documentation work. Concept 4: Leverage Debt For Multiple Expansion Leveraging debt for multiple expansion is a strategy used by private equity firms to increase their value and profitability.

How2Exit

JULY 3, 2023

They act as intermediaries between buyers and sellers, helping to facilitate negotiations, conduct due diligence, and ensure a smooth transition. Whether it is in a specific industry or as a generalist, a skilled advisor can provide valuable insights, facilitate negotiations, and ensure a successful outcome.

Sun Acquisitions

SEPTEMBER 18, 2023

Understanding the value of your business will help you set a realistic asking price and negotiate effectively with potential buyers. These experts will help you navigate negotiations, draft contracts, ensure legal compliance, and maximize the value of your deal. Be prepared to compromise while protecting your interests.

How2Exit

SEPTEMBER 26, 2023

These deals offer unique advantages, such as faster transactions, potential tax benefits, and the ability to negotiate favorable terms. This exclusivity can lead to better negotiation opportunities, favorable terms, and the potential for higher returns on investment. rn Why Go Off-Market?

Focus Investment Banking

SEPTEMBER 17, 2024

We first assemble a target list of strategic buyers and private equity groups that have an interest in the type of business we are representing. An LOI is a crucial document that outlines the basic terms and conditions of the transaction. While the LOI is a preliminary document, it should still cover all critical aspects of the deal.

The TRADE

DECEMBER 6, 2023

In answer to this, FIX split the types of addressable liquidity into four subcategories in its European equities addressable liquidity document: Interactable liquidity, multilateral liquidity, multilateral “lit” liquidity, and multilateral “lit” liquidity excluding frequent batch auctions.

Software Equity Group

JULY 9, 2024

Following many months of intense negotiation, if you are not prepared when the buyer or their advisor requests certain data or information, it can throw off the entire timeline. Missing or inadequate corporate governance documentation is a common risk for founder-led companies. First, confirm your company’s capitalization table.

How2Exit

MARCH 16, 2023

Concept 3: Prove Integration Capability When it comes to proving integration capability to potential private equity firms, entrepreneurs should focus on providing leverage to their businesses. This will demonstrate to potential private equity firms that the business is structured to implement or integrate acquisitions.

iMerge Advisors

APRIL 15, 2025

Why Open Source Raises Red Flags in M&A Buyers particularly strategic acquirers and private equity firms are increasingly cautious about open-source software (OSS) usage. How to Prepare for Diligence: A Strategic Checklist To avoid surprises during due diligence, founders should proactively audit and document their open-source usage.

Lake Country Advisors

DECEMBER 5, 2024

Financial Statements Start with a thorough review of financial documents. Balance Sheets : Evaluate assets, liabilities, and equity to assess your company’s overall financial health. Maintaining well-documented and error-free financial records boosts your credibility and supports a smooth valuation process.

Sun Acquisitions

OCTOBER 21, 2024

Additionally, the application process can be lengthy and rigorous, requiring detailed financial documentation and due diligence. Private Equity Investment: Private equity firms can be strategic partners for mid-sized businesses looking to finance M&A transactions.

Sun Acquisitions

JUNE 9, 2025

Sales breakdowns by service category or product line, a precise inventory, lease agreements, and other documents should all be carefully kept. Showing operational documents for the business, such as detailed process maps for workflows and quality control procedures, is another important step. Advisors are also valuation experts.

How2Exit

NOVEMBER 6, 2023

rn rn Quotes: rn rn "You want to make sure that you have the proper people in place, documentation of the existing process, and the existing business before you add on anything new." By documenting existing processes and identifying areas for improvement, companies can streamline operations and increase efficiency.

Sun Acquisitions

APRIL 25, 2023

This is meant to help formulate more accurate valuations while also acting as reference points when discussing individual items during negotiations – having this data on hand helps streamline processes & ensures everyone involved has all necessary information before making decisions.

Software Equity Group

APRIL 9, 2024

It’s exciting when a private equity investor or strategic buyer shows interest in your company, but it’s essential not to get carried away, especially early in the courting process. Doing so too soon could weaken your position in negotiations or cause misunderstandings. LEARN MORE: Why Software Companies Choose Software Equity Group 4.

Wizenius

MAY 4, 2023

In investment banking, a term sheet is a non-binding document that outlines the basic terms and conditions of an investment or financing deal between two parties. It serves as a starting point for negotiations and helps both parties understand the structure of the proposed transaction.

iMerge Advisors

APRIL 11, 2025

Negotiation & LOI (12 months): Term sheet discussions, exclusivity, and selection of the lead buyer. Due Diligence & Closing (23 months): Legal, financial, and technical diligence, followed by final documentation and closing. ARR multiple with partial rollover equity. Buyer Type Strategic buyers (e.g.,

Sica Fletcher

OCTOBER 23, 2024

It also opens the door for savvy buyers to talk them out of millions of dollars when it comes time for negotiations. These documents include: How To Value an RIA: Key Documents by Type Sellers should be prepared to have their M&A advisor or a third party (usually provided by the advisor) review these documents in detail.

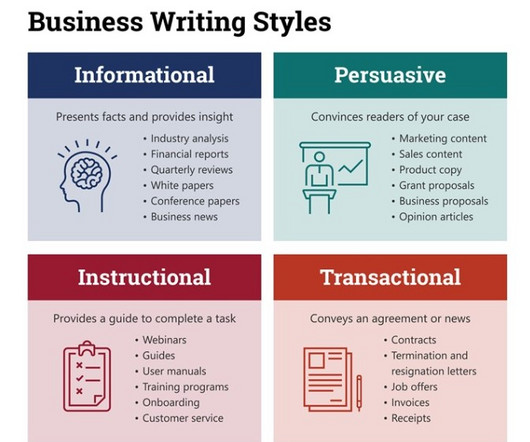

Peak Frameworks

AUGUST 15, 2023

Organization and Structure A well-structured document makes it easier for the reader to follow your points. This is particularly important in lengthy documents like annual reports. And remember, a well-proofread document is non-negotiable. Tailor your language to your audience. Incorporating data is also key.

How2Exit

AUGUST 8, 2023

This strategy involves a business, private equity owner, or sponsor selling its company-owned real estate that is considered mission-critical to its operations. By selling a non-core asset at a higher multiple than the broader business would trade, the business can see equity value creation.

iMerge Advisors

APRIL 8, 2025

Your answers will shape the type of buyers you target from strategic acquirers to private equity firms or growth investors. litigation, debt) are disclosed Team & Org: Document key roles, retention plans, and any dependencies on founders or key personnel Many founders underestimate the time and effort required here.

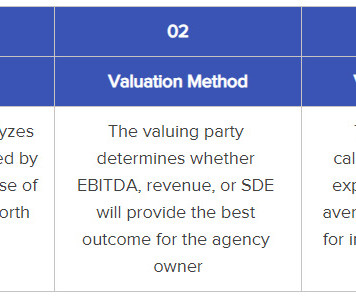

Sica Fletcher

APRIL 30, 2024

The following table contains a comprehensive list of the documents our teams use to value an insurance agency. How To Value an Insurance Agency: Required Documentation Your M&A advisor will use these documents to value your agency, as detailed in the sections below.

Cleary M&A and Corporate Governance Watch

FEBRUARY 2, 2024

The Tesla board fell short on many – seemingly, all – levels: directors were not independent, their process was flawed in terms of timeline, negotiation etiquette, and a failure to conduct appropriate benchmarking, they did not fully inform their shareholders, and did not properly justify the scope of Musk’s staggering compensation.

Cooley M&A

SEPTEMBER 16, 2024

One strategy for moving forward in a merger of equals transaction is to agree on a timeline for aligning on key issues and then only move to drafting definitive documents once the key issues have been agreed. Like in an equity financing transaction, the combined company will often establish a new go-forward equity pool.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content