Debt portability provides a lifeline for M&A

JD Supra: Mergers

AUGUST 29, 2024

By: White & Case LLP

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

JD Supra: Mergers

AUGUST 29, 2024

By: White & Case LLP

Midaxo

AUGUST 2, 2023

The most recent Transaction Advisors Institute (TAI) M&A conference was held at the University of Chicago in late June and covered topics ranging from current challenges impacting complex transactions to innovative methods to improve deal performance. Key M&A Takeaways for Q2 2023 1.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Francine Way

MAY 15, 2017

That debt should be used prudently, taking into account future financial shocks that require financing flexibility. That debt should be used prudently, taking into account future financial shocks that require financing flexibility. If there is enough surplus available, the remainder can be used to finance an M&A transaction.

JD Supra: Mergers

AUGUST 16, 2024

Distressed mergers and acquisitions (M&A) involve companies in financial or operational distress, potentially on the brink of insolvency or already grappling with significant debt burdens.

JD Supra: Mergers

DECEMBER 13, 2023

Welcome to our year-end edition of M&A Insights, where we preview some of the themes we expect to shape deal-making over the next 12 months. Continued volatility in the debt markets has resulted in another subdued year for M&A, with global deal value and volume down 33% and 18% respectively compared with 2022.

JD Supra: Mergers

DECEMBER 7, 2023

There is a wealth of dry powder to spend but 2023 has seen M&A deal activity hampered by rising costs of debt, unstable markets, supply chain issues, general political uncertainty, and fear of global recession. So, what does 2024 have in store for European M&A? By: Proskauer Rose LLP

Francine Way

MAY 17, 2017

The concept can be extended to M&A. Thus far, we have discussed many aspects around capital structure and debt financing, including how debt levels are determined by a company’s cash flows, enterprise value, and asset values. This post is the last one of our debt discussion.

JD Supra: Mergers

NOVEMBER 1, 2024

In recent years, the landscape of mergers and acquisitions (M&A) financing in private equity (PE) has experienced significant changes. Rising costs of debt and fluctuating availability have compelled PE firms to reassess their financing strategies. By: Bennett Jones LLP

JD Supra: Mergers

SEPTEMBER 19, 2024

Net Working Capital (“NWC”) targets and purchase price adjustments are a nearly universal reality in private M&A deals, though often a neglected and misunderstood topic. By: Whiteford

Francine Way

MAY 14, 2017

In the last two blog posts, we walked through capital structure and how it impacts M&A activities and vice versa. To be explicitly clear, I am recommending the use of the following ranked capital sources when paying for an acquisition: cash (from the balance sheet), debt (at a reasonable level), and equity.

JD Supra: Mergers

DECEMBER 8, 2023

At McGuireWoods’ 16th annual Healthcare Finance & Growth (HCFG) Conference, panels of healthcare-focused investors and lenders provided insights about the healthcare M&A and debt markets. By: McGuireWoods LLP

JD Supra: Mergers

NOVEMBER 29, 2023

Whole-business securitization (WBS), a structured finance product where a company issues secured debt against substantially all of its cash-yielding assets, is now on the radar of dealmakers seeking ways to manage M&A financing costs or increase overall leverage. By: White & Case LLP

TechCrunch: M&A

OCTOBER 5, 2023

billion to acquire SP Plus, a provider of parking facility management services, in a combination of equity and debt. AI-powered parking platform Metropolis today announced that it raised $1.7

Beyond M&A

FEBRUARY 19, 2025

At Beyond M&A, we prefer to call it Pre-Emptive Due Diligence. For example, spending a day with the CTO, reviewing their stories, challenges, and investment history, might reveal underlying team dynamics or a technical debt problem thats quietly driving attrition. But I digress. But doing so defeats the purpose.

Francine Way

MAY 18, 2017

Before we move on to the buy-side and sell-side process of M&A next week, I’d like to wrap up this week by discussing the other capital structure component / tool: equity. The concept can be extended to corporation: equity owners (shareholders) own the company alongside debt holders (banks). However it is also the most flexible.

Francine Way

JULY 17, 2017

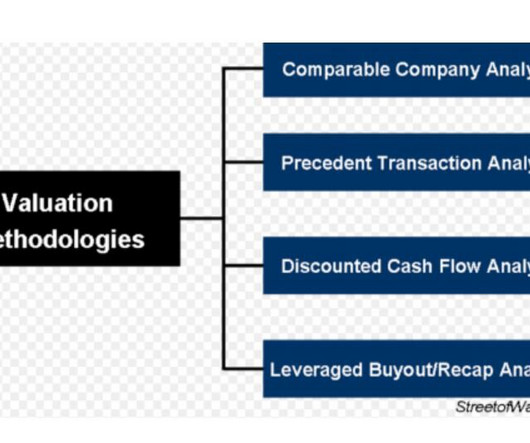

Building a historical 3-statement model and a debt-interest schedule. Building the go-forward debt-interest schedule. Thus far, we have discussed three common valuation methods that most strategic and financial acquirers use when valuing a company for acquisitions or investments. Indeed, that is the scenario that I’m familiar with.

Francine Way

JULY 7, 2017

Thus far in the last 10 blog posts, we have discussed what M&A is, its success metrics, types of acquirers and value creations, capital structure, debt, and equity. In Blog #02 of the M&A series, we discussed SWOT analysis. and (4) support long-term business strategy. Management: How strong is target’s management?

Francine Way

JULY 10, 2017

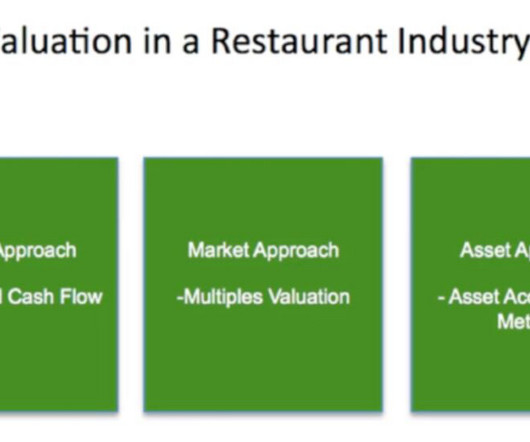

It is no different in M&A. The core element of M&A is company valuation. It is not an exaggeration to say that firm value is the most important characteristics in M&A. Do they have the cash of debt/equity capacity to bid aggressively? It drives prices, ROI, and financing.

Francine Way

JULY 12, 2017

Calculate cost of debt, cost of equity, and weighted average cost of capital (WACC). For interest income and expense, I prefer to state them as percentages of the average debt balance of the last two years. Essentially, it is a way to value a company based on cash generated from operation, taking into account all major expenses.

JD Supra: Mergers

OCTOBER 2, 2024

Equity and debt cheques from financial sponsors fuel growth, with investment committee appetite across the full spectrum from Seed through to late stage / pre-IPO. Current market: M&A activity levels retain a monumental high. The payments sector bucks the trend on IPOs. By: White & Case LLP

Midaxo

APRIL 25, 2023

Introduction This article showcases how ChatGPT can serve as an effective M&A consultant by demonstrating how it can be used to help develop a best practices-based M&A playbook. An M&A playbook is a comprehensive framework that guides an organization’s M&A activities from start to finish.

Mergers and Inquisitions

SEPTEMBER 13, 2023

Ask anyone interested in distressed debt hedge funds for “the pitch,” and they’ll probably mention one of the following: “It’s like long/short equity or credit , but more interesting!” Distressed debt investing offers advantages over other hedge fund strategies , but the marketing often oversells the benefits.

Francine Way

JULY 9, 2017

The comparisons can be based on several factors: Valuation: Total value, structure, contingencies, forms of payment (cash, buyer’s stocks, target’s stocks, seller’s notes, post-transaction debt, and more), and deferred payments (payments based on future performance) should be evaluated. The reason for this is time.

TKO Miller

OCTOBER 3, 2023

TKO Miller Debt Capital Market Analysis Leverage multiples have pulled back significantly in M&A transactions from their 2021 peaks due to a tightening of the lending environment, Sr. Debt / EBITDA, decreased from 4.0x Debt remains most available in the lower middle market sector. in 2021 to 3.5x

JD Supra: Mergers

SEPTEMBER 26, 2023

UK & European Financial Services M&A: Sector trends H2 2022 | H1 2023 — Asset/Wealth Management - Sub-sector M&A activity levels soar—market moving deals across wealth management, financial planning, fund management, debt servicing, trust administration, direct lending and private equity funds in the last 12 months.

Francine Way

JULY 13, 2017

Calculating cost of debt, cost of equity, and weighted average cost of capital (WACC). Enterprise Value = Market Capitalization + Total Debt - Total Cash. When one is buying or selling a house, condo, or other real estate property; often times, one would like to know the going price of similar nearby properties.

How2Exit

OCTOBER 8, 2023

Their team is experienced in M&A, and they hire the best talent available. rn Summary: Arthur Petropoulos, managing partner at Hill View Partners, shares his journey into the world of mergers and acquisitions (M&A) and discusses the services his firm provides. rn rn Quotes: rn rn "Our firm, we help companies sell themselves.

TechCrunch: M&A

SEPTEMBER 7, 2023

As companies look to stave off technical debt, a process of aging systems limiting a company’s ability to modernize, the first step is simply understanding the state of your architecture. SAP announced today that it is acquiring German startup LeanIX, a software service which helps companies map out their architecture.

Francine Way

JULY 11, 2017

Just as any home appraiser or credit officer does before going through the analytical exercise to produce a score for a home or a borrower, valuation professionals go through several steps of preparation before the actual exercise of producing a number that can be used as a value of a company.

How2Exit

SEPTEMBER 9, 2024

E242: The Art of the Deal: Steve Rooms' Masterful M&A Strategies, Unraveling the Secrets to Success - Watch Here About the Guest(s): Steve Rooms is a seasoned financial expert and serial entrepreneur with extensive experience as a Chief Financial Officer (CFO). Episode Summary: Welcome to the latest episode of the How2Exit podcast!

Francine Way

JULY 20, 2017

Thus far, we have covered four popular valuation methods in M&A (DCF, Comparable Company, Precedent Transaction, and LBO) and one less known one that is making its way out of the academic realm into the business world (Dividend Discount Method, DDM). The 1st one for today is the Tangible Book Value (TBV) method.

TechCrunch: M&A

OCTOBER 10, 2023

Arctic Wolf, a cybersecurity company that’s raised hundreds of millions of dollars in debt and equity, today announced that it plans to acquire Revelstoke, a company developing a security orchestration, automation and response (SOAR) platform, for an undisclosed amount.

Francine Way

JUNE 22, 2020

Many things have happened since then, including having 2 Corporate Development & Strategy jobs with a large, domestic conglomerate in Jacksonville, Florida and a smaller international technology company in Seattle, Washington. As a Corporate Development & Strategy personnel, my task was to answer these questions.

JD Supra: Mergers

DECEMBER 13, 2023

M&A, debt finance and investment fund actors seek alternative routes to dealmaking in the face of a dim macroeconomic outlook - The past two years have witnessed significant geopolitical fracturing and macroeconomic difficulties that continue to hamper certain dealmaking.

Software Equity Group

JUNE 14, 2023

For that reason, it can pay to learn more about NWC, what it might or might not include, and how an M&A advisor can help you negotiate more favorable terms to maximize your proceeds. First, it’s important to understand that most M&A transactions are completed on a cash-free, debt-free (CFDF) basis.

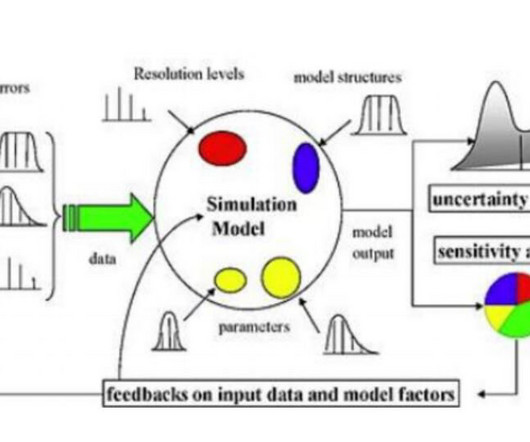

Francine Way

JULY 19, 2017

In all of these discussions, we assumed a set of static values for our variables. In other words, we assumed that each variable can have only one value. Well, in the real world, there is no certainties in business. Grays exist more than black and white; multiple possibilities exist, leading to multiple outcomes.

Francine Way

JULY 14, 2017

Implied Transaction TEV = Implied Purchase Price + Debt + Preferred Stock + Minority Interest - Cash. As I mentioned in the last post , when one is buying or selling a house, condo, or other real estate property; often time, one would like to know the going price of similar nearby properties.

Devensoft

JUNE 1, 2023

Chapter 1: A Modern Due Diligence Guide for Today’s Economy Merger and acquisition (M&A) due diligence is a crucial process for businesses looking to acquire or merge with another. According to a study by Deloitte, over 90% of M&A deals fail to achieve their objectives, often due to inadequate due diligence.

Global Newswire by Notified: M&A

OCTOBER 28, 2024

Array acquired Payitoff, a pioneer in private-label, embedded debt guidance solutions for financial institutions, fintechs and brands.

How2Exit

MAY 15, 2023

Ron Concept 1: Why He Got Into Corporate Law Entering the corporate law field can be a daunting prospect, but it can also be incredibly rewarding. Matthew Sauer, co-founder and partner of Wolverine Co., a strategic legal advisory out of New York City, is a prime example of someone who has been successful in this field.

Synopsys: M&A

JANUARY 27, 2023

Understanding how software is developed and the areas impacted by technical debt can help lawyers and investors assess software risks during an M&A.

TechCrunch: M&A

JULY 25, 2023

Indeed, iRobot has said that it is having to raise $200 million in debt to “fund its ongoing operations,” a debt that Amazon will take on when (or if) the deal finally closes — and that is why it has tabled a new lower bid for iRobot. While the U.K. While the U.K. In the U.S., In the U.S.,

Sun Acquisitions

OCTOBER 21, 2024

In the dynamic world of mergers and acquisitions (M&A), financing plays a pivotal role in bringing deals to fruition. For mid-sized businesses eyeing growth opportunities through M&A, understanding the available financing options is essential for success.

Deal Lawyers

NOVEMBER 2, 2023

If you needed any more proof about how challenging M&A financing conditions are, check out this recent Axios article, which says that equity contributions to US LBO transactions are at record levels. The article says the reason that PE sponsors are putting more skin in the game is simple – debt is getting very expensive: […]

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content