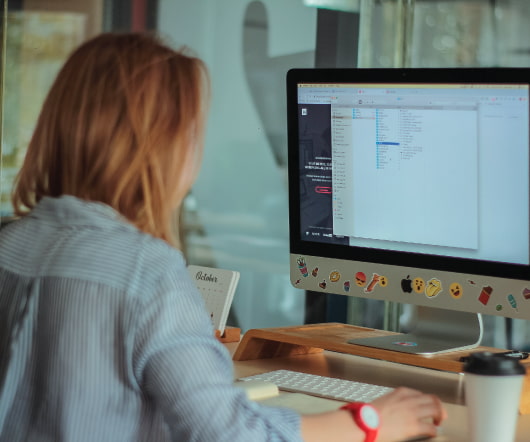

A DOJ Private Equity Declination and Its Lessons for Acquirers and Targets

JD Supra: Mergers

JUNE 23, 2025

The DOJ declined to prosecute a private equity firm for its portfolio company’s pre-acquisition sanctions and export violations, marking the first application of the National Security Division’s M&A Policy.

Let's personalize your content