Corporate Finance Jobs: Cozy Careers, But Bad “Plan B” Options

Mergers and Inquisitions

OCTOBER 30, 2024

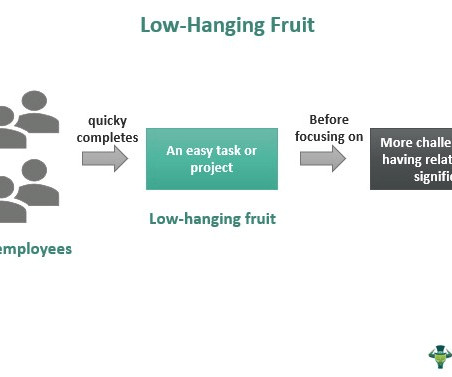

Corporate finance jobs at normal companies are bad … …if you’re using them to break into a deal-based field, such as investment banking , private equity , or venture capital , or as a “Plan B” if you interview around but do not get into one of these. In my view, corporate finance jobs are not ideal “stepping stone roles.”

Let's personalize your content