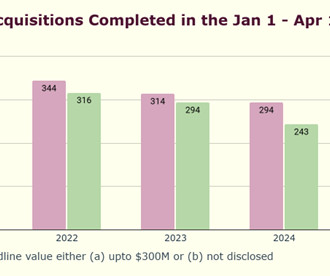

FOCUS Investment Banking Named a Top 25 Lower Middle Market Investment Bank by Axial for Q2 2025

Focus Investment Banking

JULY 25, 2025

FOCUS Investment Banking Named a Top 5 Lower Middle Market Investment Bank by Axial for Q2 2025 Washington, DC, (July 25, 2025) – FOCUS Investment Banking (“FOCUS”) is proud to announce that it has been ranked the #2 investment bank on Axial’s Top 25 Lower Middle Market Investment Banks for the second quarter of 2025.

Let's personalize your content