MergersCorp M&A International and Spektrum Capital Advisors LLC Announce Strategic Alliance to Enhance Capital Access for Growing Businesses

MergersCorp M&A International

JUNE 14, 2025

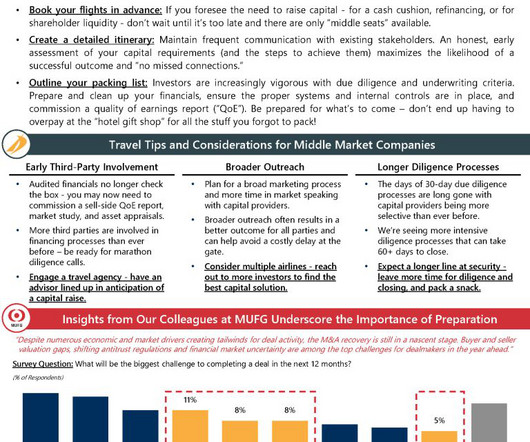

NEW YORK, UNITED STATES OF AMERICA – June 14, 2025 – MergersCorp M&A International, a distinguished advisory firm specializing in Investment Banking, cross-border Mergers and Acquisitions (M&A) and comprehensive corporate finance solutions for clients globally, and Spektrum Capital Advisors LLC, a U.S.-based

Let's personalize your content