Investment Banking in Dubai: The New York of the Middle East?

Mergers and Inquisitions

JUNE 21, 2023

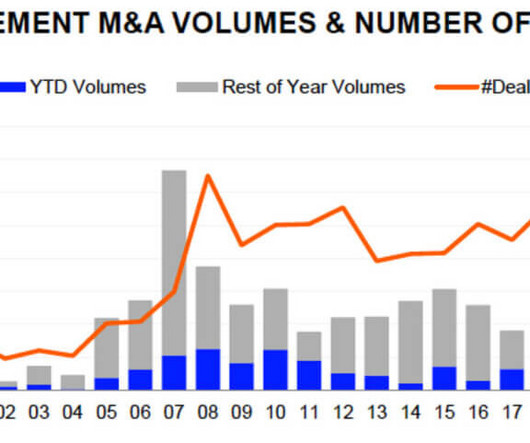

There are usually a few hundred M&A deals per year for $50 – $100 billion of total volume : For context, that’s less activity than Canada in an average year, and it’s about 5-10% of the deal volume of the Asia-Pacific (APAC) region. bulge-bracket banks , such as JPM, GS, MS, and Citi, always rank well in the league tables.

Let's personalize your content