Manufacturing Heats Up in Private Equity: What the Data Tells Us

Sun Acquisitions

JUNE 17, 2025

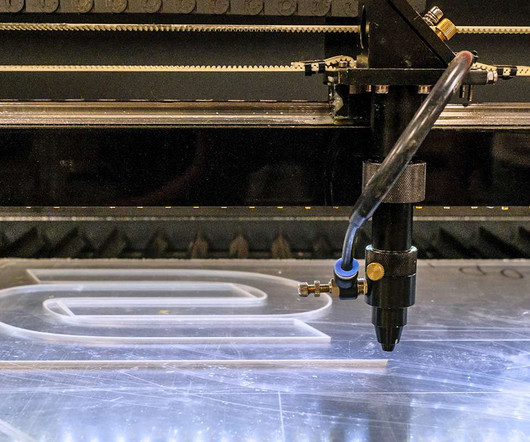

Yet, recent data tells a different story—one of strong and sustained interest in industrial businesses that are quietly powering some of the most active deal-making in the middle market. Most notably, 580 of these deals involved U.S. McNally Capital acquired Jewett Automation , a general-purpose machinery manufacturer.

Let's personalize your content