FOCUS Investment Banking Named Top 50 Industrials M&A Advisor by Axial

Focus Investment Banking

JUNE 19, 2025

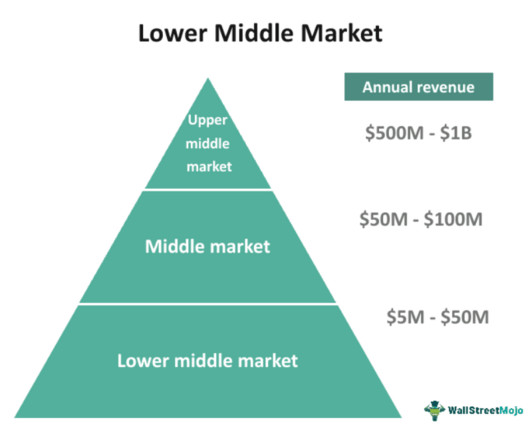

FOCUS Investment Banking Named Top 50 Industrials M&A Advisor by Axial FOCUS Investment Banking (“FOCUS”), a leading national middle market investment banking firm, is proud to announce it has been named one of the Top 50 Industrials M&A Advisors by Axial , the leading platform for lower middle market dealmaking.

Let's personalize your content