Best Practices for Due Diligence and Valuation in M&A

Sun Acquisitions

JUNE 27, 2025

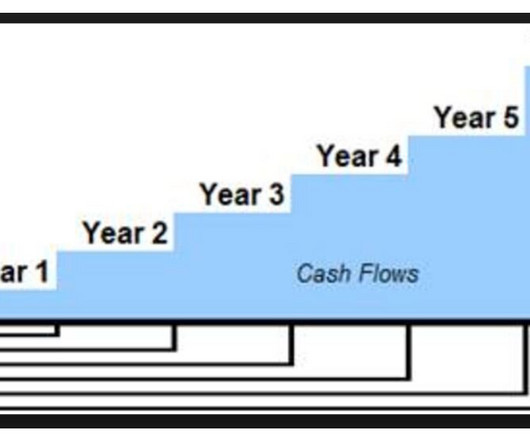

Due diligence and valuation are critical to any successful merger and acquisition (M&A) deal. Assess the company’s financial performance, including revenue, profitability, and cash flow. Discounted Cash Flow (DCF) Analysis: Projects future cash flows and discounts them to their present value.

Let's personalize your content