Delta Capita launches platform to automate OTC derivatives post-trade

The TRADE

JULY 2, 2025

The post Delta Capita launches platform to automate OTC derivatives post-trade appeared first on The TRADE.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

The TRADE

JULY 2, 2025

The post Delta Capita launches platform to automate OTC derivatives post-trade appeared first on The TRADE.

The TRADE

JULY 1, 2025

SIX has completed its acquisition of Aquis, eight months after the deal was first announced. Through the move, SIX and Aquis are have an aggregated 15% market share and access to 16 capital markets across Europe. Additionally, as part of the acquisition, SIX is also set to deploy Aquis’ next-generation technology.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

The TRADE

JANUARY 10, 2025

The acquisition comes as part of MetLifes strategy to accelerate growth in asset management and MIMs efforts to expand offerings and channels, alongside adding higher yield capabilities. This includes the strategies expected to be added through the announced acquisition of PineBridge Investments.

MergersCorp M&A International

JULY 5, 2025

In the frenetic world of finance, few instruments have sparked as much debate, and perhaps as much misunderstanding, as the Special Purpose Acquisition Company, or SPAC. The capital raised in the IPO is placed in a trust account, earning interest, and can only be used for an acquisition or returned to investors.

The TRADE

JULY 18, 2025

Adam Matuszewski has rejoined SIX as managing director and part of the management committee for exchanges, following a year-long stint at Citadel Securities, The TRADE can reveal. London-based Matuszewski returns to SIX after having previously left in February 2024 following a 10-year tenure with the firm. During his time at the exchange, he (..)

The TRADE

JULY 31, 2025

in H1, with its markets division up 11.7 % year-on-year. David Schwimmer The markets offering provides secondary market trading for equities, fixed income, interest rate derivatives, foreign exchange (FX) and other asset classes, as well as clearing, risk management, capital optimisation and regulatory reporting solutions. A 17.9%

CNBC: Investing

AUGUST 1, 2025

Corporate earnings growth, moderate economic data, expectations that the Federal Reserve may soon resume cutting interest rates and progress in trade talks have all served as upward catalysts in recent weeks. "Talent + synergies + M & A/capital markets recovery = lots of free cash flow," Goldman Sachs wrote.

The TRADE

JANUARY 14, 2025

Capital markets technology provider Trading Technologies (TT) has moved to enhance its institutional clients visibility and agility in the equities markets with the launch of a new broker ranking system. The system is based on trade data compiled by Abel Noser Solutions which TT acquired in 2023.

The TRADE

JULY 8, 2025

In his new role, Fidance will be based out of London, where he is set to expand access new markets and liquidity, and enhance product and distribution as well as engagement with local and international asset managers.

The TRADE

JULY 1, 2025

Euronext has confirmed that it is currently in discussions to acquire the Athens Stock Exchange (ATHEX) in a deal thought to value the trading venue at €399 million (on a fully diluted basis). The deal would value the Athens-based trading venue at €6.90 An official offer submission is subject to due diligence.

CNBC: Investing

JULY 18, 2025

"Roku elected not to raise its 2025 Platform revenue guidance last qtr despite the announced Frndly acquisition, effectively leaving room for some weakening in the macro environment," the analyst said.

The TRADE

JULY 17, 2025

The report confirmed generally strong trading across most asset classes and stronger capital formation spurring this growth, with particularly strong gains in trading, clearing, and settlement (TC&S) and market technology and access (MT&A). Global exchange revenues reached $58.9 billion in 2024, demonstrating a 7.5%

The TRADE

AUGUST 1, 2025

Non-volume related revenue accounted for 58% of the quarter’s total revenue, with areas such as capital markets and data solutions revenue seeing a 12% increase to €165.4 The exchange pointed towards favourable market conditions as a key driver for the strong revenues. growth of FX trading to €9.3 and totalling €51.7

CNBC: Investing

JUNE 21, 2025

The first half of the year was characterized by high volatility, as President Donald Trump's escalating trade war cast a shadow over the market. But with trade negotiations ongoing, Wall Street is cautiously optimistic entering the second half of the year that deals can be reached. natural gas.

Mergers and Inquisitions

MAY 14, 2025

Infrastructure Investment Banking Definition: In infrastructure investment banking, bankers advise companies in the data center, renewables, transportation, utilities, and energy storage/transportation markets on equity and debt issuances, asset deals, and mergers and acquisitions.

The TRADE

FEBRUARY 29, 2024

The London Stock Exchange (LSEG) saw overall growth across its key businesses in 2023, with considerable improvement across data and analytics, capital markets, and in particular, post-trade. year-on-year increase, while capital markets saw a 6.1% In capital markets, the 6.1%

JD Supra: Mergers

APRIL 16, 2024

There have been 44 initial public offerings (IPOs) listed on the US stock markets in 2024 thus far, many of which continue to trade at a premium to their initial offering price, demonstrating the strength and buoyancy of current public markets.

The TRADE

FEBRUARY 27, 2024

Fintech giant FIS has acquired SaaS post-trade platform Torstone Technology, according to multiple sources close to the matter. The deal will further bolster FIS’ capital markets technology offering, having acquired SunGard in a major deal back in 2015.

The TRADE

DECEMBER 1, 2023

Commodities specialist Marex has completed its acquisition of TD Cowen’s outsourced trading and prime brokerage business, first announced in September. It’s something that we learned to do quite well when we got to Cowen and we had a lot of success with working with different product lines,” Rosen told The TRADE.

The TRADE

APRIL 22, 2024

BMO Capital Markets managing director and co-head of electronic trading has left the bank, The TRADE can reveal. After 10 years as co-founder of Clearpool and MD at BMO, I have decided to take some time away from electronic trading. It has been an amazing journey,” said Wald in an update.

The TRADE

DECEMBER 4, 2023

Trading Technologies (TT) has made three new appointments to its senior leadership team, including chief operating officer; executive vice president of fixed income; and executive vice president of futures and options – all of which will join the firm on 1 January 2024.

The TRADE

DECEMBER 27, 2023

Marex to acquire Cowen’s prime brokerage and outsourced trading business from TD At number ten was a story broken by The TRADE in September, news that Cowen’s prime brokerage and outsourced trading business had been acquired by Marex just six months after TD completed its purchase of the business.

The TRADE

DECEMBER 1, 2023

Justin Llewellyn-Jones, head of capital markets, North America (equities, FX and derivatives) and chief product officer for capital markets at fintech firm Broadridge has announced his departure after more than four years with the business. The post Broadridge capital markets head to depart appeared first on The TRADE.

The TRADE

APRIL 29, 2024

The new desk is Investec’s first low touch offering based in London and comes off the back of increased client demand, The TRADE understands. Lowres joins Investec as head of electronic trading and execution strategy after almost 17 years with Liberum. Alongside him, Matthew West joins Investec as a global electronic sales trader.

The TRADE

AUGUST 3, 2023

The London Stock Exchange Group (LSEG) has reported positive first half results on the back of strong growth in its data and analytics and post-trade divisions. Total income grew to £4 billion, marking an 8% increase in comparison with H1 results from 2022, largely thanks to an “outstanding” 19% growth in post-trade revenues.

The TRADE

AUGUST 1, 2024

The London Stock Exchange Group (LSEG) achieved a strong H1 according to results released on Thursday, with growth across capital markets, data and analytics, post-trade and its index business. “We In April, Tradeweb announced the acquisition of ICD, a cash management platform for corporate treasurers.

Global Newswire by Notified: M&A

SEPTEMBER 20, 2023

20, 2023 (GLOBE NEWSWIRE) -- Nocturne Acquisition Corporation (NASDAQ:MBTC, MBTCU, MBTCR) ("Nocturne") and Cognos Therapeutics, Inc. This strategic move marks Cognos's journey towards becoming a publicly traded company on the NASDAQ Stock Exchange. WILMINGTON, Del. and INGLEWOOD, Calif.,

Global Newswire by Notified: M&A

AUGUST 23, 2023

OTCQB: SNWV) has entered into a definitive merger agreement with SEP Acquisition Corp. Upon closing, the combined company is expected to trade on the Nasdaq Capital Market under the symbol “SNWV”. · SANUWAVE Health Inc. Nasdaq: SEPA).

The TRADE

SEPTEMBER 22, 2023

Cowen’s prime brokerage and outsourced trading business has been acquired by Marex just six months after TD completed its purchase of the business. Following the acquisition, both businesses will continue to be led by Jack Seibald and Michael Rosen. TD Bank Group completed its all-cash $1.3

The TRADE

MARCH 11, 2024

BNY Mellon made two key senior managing director hires into its fixed income and equity sales and trading businesses. Gould joined BNY Mellon after three years at RBC Capital Markets where she previously served as co-head of equities electronic sales and trading.

Mergers and Inquisitions

OCTOBER 18, 2023

Even though we’ve covered industry groups vs. product groups and teams such as M&A , ECM , DCM , and Leveraged Finance , we continue to get questions about capital markets vs. investment banking. The questions usually go like this: Are capital markets teams (ECM, DCM, and LevFin) “real” investment banking?

The TRADE

DECEMBER 13, 2023

Trading Technologies International (TT) has unveiled two new dedicated business lines, TT Compliance and TT Quantitative Trading Solutions (QTS), to fuel growth for 2024 across asset classes. The post Trading Technologies launches two business lines to support company’s expansion into new asset classes appeared first on The TRADE.

Global Newswire by Notified: M&A

AUGUST 17, 2023

(“Able View,” or the “Company”), one of the largest comprehensive brand management partners of international beauty and personal care brands in China, today announced that it has completed its previously announced business combination with Hainan Manaslu Acquisition Corp. Upon the closing of the business combination, HMAC and Able View Inc.

The TRADE

OCTOBER 13, 2023

Deutsche Bank has completed the acquisition of institutional broker Numis and has unveiled a new offering to be known as ‘Deutsche Numis’. The transaction – first reported on back in April – was previously valued at £410 million according to documents seen by The TRADE.

Global Newswire by Notified: M&A

FEBRUARY 14, 2024

14, 2024 (GLOBE NEWSWIRE) -- Breeze Holdings Acquisition Corp. Nasdaq: BREZ) (“Breeze Holdings”), a publicly traded special purpose acquisition company, and TV Ammo, Inc., IRVING, Texas and GARLAND, Texas, Feb.

The TRADE

FEBRUARY 2, 2024

Following this, Winterflood cut twenty positions across its London office, including six traders, as revealed by The TRADE. Just prior to this news, two other traders, Ben Ralph-Davies and Joel Russell also left Winterflood’s London business to join rival market maker Shore Capital, according to sources.

Cooley M&A

JANUARY 19, 2023

The Inflation Reduction Act imposes a 1% excise tax on certain repurchases of stock of publicly traded US corporations (“Covered Corporations”) effected after December 31, 2022 (the “Excise Tax”). [1] This post highlights key guidance from the Notice as it relates to common M&A and capital market transactions.

The TRADE

MARCH 8, 2024

Leithner has been a member of the executive board of Deutsche Börse AG since 2018, responsible for pre- & post-trading. During that time, he has overseen the acquisition of SimCorp and Axioma, among other initiatives such as a 10-year partnership with Google Cloud. The two will operate as co-CEOs until the end of the year.

The TRADE

AUGUST 7, 2024

Outsourced trading, though undoubtedly a contentious topic, is something that has been around in capital markets for decades in some form or another. However, an undeniable surge has occurred across the trading sphere over the last few years, with decidedly mixed results. And the number is climbing.

M&A Leadership Council

FEBRUARY 27, 2024

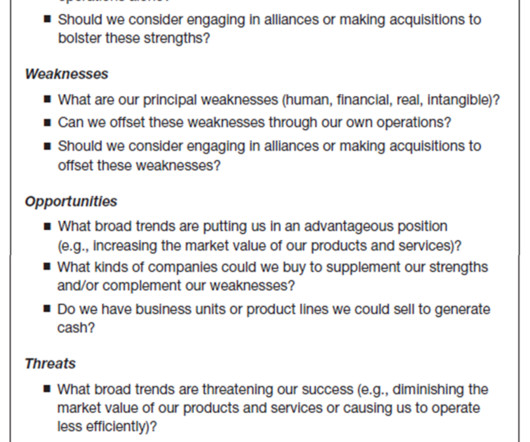

The Art of M&A® / Strategy An excerpt from The Art of M&A, Sixth Edition: A Merger, Acquisition, and Buyout Guide by Alexandra Reed Lajoux Research shows that a significant percentage of acquisitions “fail” in some way. Sometimes an acquisition is the right strategic choice, and other times this would be the wrong move.

Global Newswire by Notified: M&A

NOVEMBER 27, 2024

27, 2024 (GLOBE NEWSWIRE) -- Real Messenger Holdings Limited (“Real Messenger” or the “Company”), an innovative chat-based platform reimagining real estate connections, and Nova Vision Acquisition Corp. COSTA MESA, Calif.,

How2Exit

MAY 22, 2023

Walker Diebold, bestselling author of “Buy Then Build: How to Acquisitions Entrepreneurs Outsmart the Startup Game,” experienced the stock market firsthand as a stockbroker and learned valuable lessons from his experiences. Walker began his career as a stockbroker, advising clients on asset allocation and executing trades.

The TRADE

OCTOBER 12, 2023

UK-based Marex has joined the Australian Securities Exchange (ASX) as futures clearing and trading participant with the move slated to increase competition within the currently heavily concentrated market. The post Australian Securities Exchange welcomes Marex as futures clearing participant appeared first on The TRADE.

The TRADE

DECEMBER 4, 2023

Sparacino has an extensive career in options trading after also previously in senior sales and options roles for four years at Dash Financial Technologies and six and a half years at ConvergEx Group. The post People Moves Monday: Matrix Executions, Broadridge and CLSA appeared first on The TRADE.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content