UK Corporate Briefing - August 2025

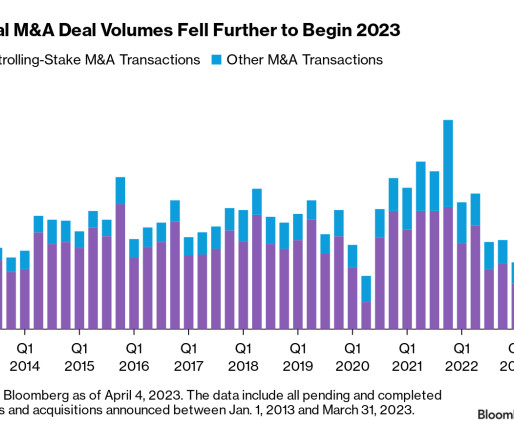

JD Supra: Mergers

AUGUST 1, 2025

Updated guidance – filing accounts with Companies House In the future all accounts must be filed at Companies House using commercial software. Updated guidance – filing accounts with Companies House From 1 April 2027 all accounts filings must be filed at Companies House using commercial software.

Let's personalize your content