How to Sell a Business in Puerto Rico (Without Losing Your Mind or Millions)

How2Exit

JUNE 23, 2025

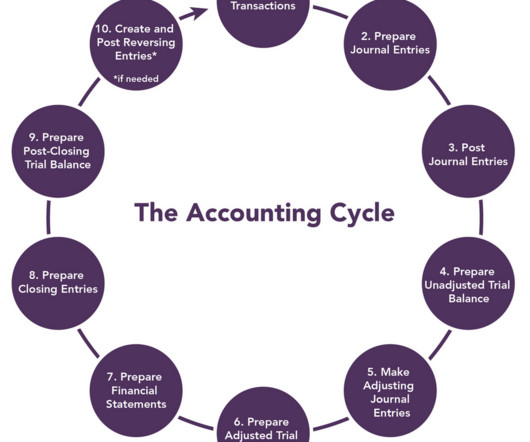

Pre-sale readiness is underrated – Many businesses, especially sub-$3M in revenue, don’t keep formal books. Sloppy books erode it instantly. Many small businesses—especially in Puerto Rico—run without accrual-based financials or even accounting software. That can make them unsellable. Then supermarkets.

Let's personalize your content