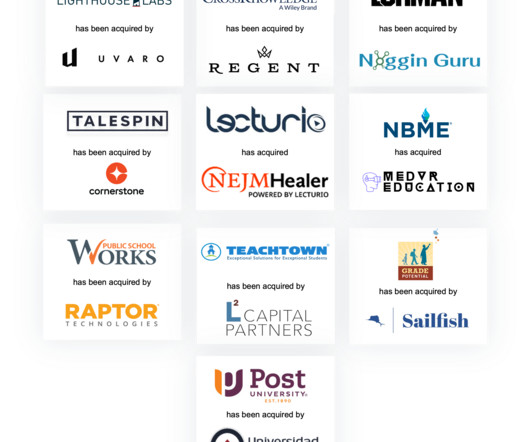

2024 Key Deal Highlights and Predictions for 2025

Tyton Partners

FEBRUARY 3, 2025

As we project toward 2025, this sector is poised to sustain its robust performance, driven by substantial investor interest and the opportunities presented by a highly fragmented market. In 2025, investors are expected to focus increasingly on companies that enhance operational efficiencies within the education sector.

Let's personalize your content