Survey: Middle Market Deal Terms

Deal Lawyers

SEPTEMBER 25, 2023

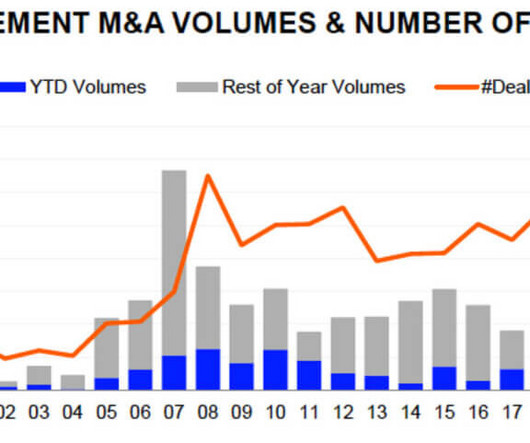

Seyfarth Shaw recently published the ninth edition of its “Middle Market M&A SurveyBook,” which analyzes key contractual terms for 105 middle-market private target deals signed in 2022 and the first half of 2023. The survey focuses on deals with a purchase price of less than $1 billion.

Let's personalize your content