Food Distribution is Ripe for M&A

Focus Investment Banking

MAY 10, 2024

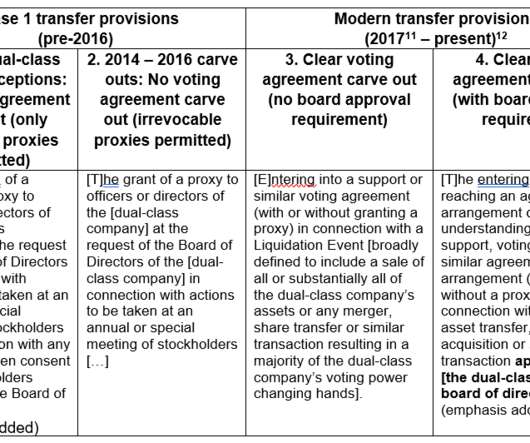

Between 2013 and 2019, food distribution generated a steady flow of deals with strategics driving the majority of activity. During the same time, private equity firms started betting on the sector, particularly in specialty segments. Financial : Private equity groups seeking to acquire a company as an investment.

Let's personalize your content