Infrastructure Investment Banking: Definitions, Deals, and a Dizzying Diversity of Verticals

Mergers and Inquisitions

MAY 14, 2025

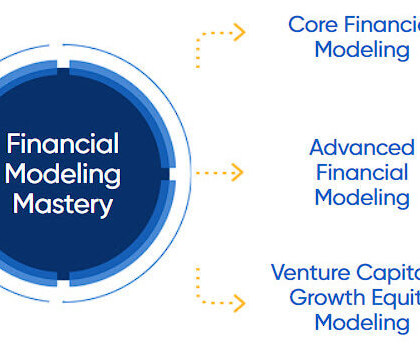

However, MLPs have become less popular since the 2017 tax reform, and many Midstream companies have converted to C-Corporations and now pay corporate taxes. that is sort of infrastructure in the Private Equity Modeling course. The difference in Midstream, at least in the U.S., Outside the U.S.,

Let's personalize your content