Roblox acquires voice moderation startup Speechly

TechCrunch: M&A

SEPTEMBER 20, 2023

The Helsinki, Finland-based startup Speechly was founded in 2016 with the […]

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

TechCrunch: M&A

SEPTEMBER 20, 2023

The Helsinki, Finland-based startup Speechly was founded in 2016 with the […]

How2Exit

JULY 22, 2024

E233: Guide to Sourcing Deals and Increasing Deal Flow for Business Acquisitions with Expert Tips - Watch Here About the Guest(s): Conner Young Conner Young is the co-founder of Kairo Data, a company that focuses on helping investors and searchers source and find business deals. How does that make you money?" "You

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

JD Supra: Mergers

JUNE 21, 2023

The Delaware Supreme Court recently affirmed the Delaware Court of Chancery’s 2022 post-trial decision that Tesla’s 2016 all-stock acquisition of SolarCity Corp. satisfied the entire fairness standard of review, and thus did not involve breaches of fiduciary duty. See In re Tesla Motors Stockholders’ Litigation, A.3d 6, 2023).

TechCrunch: M&A

JULY 18, 2023

This acquisition augments Logitech’s product portfolio today and accelerates our software ambitions of enabling keyboards, mice and more to become smarter and contextually aware, creating a better experience for audiences across Logitech.” Loupedeck was founded in 2016 by former Nokia/Microsoft employees (hence Helsinki).

JD Supra: Mergers

JULY 5, 2023

On June 6, 2023, in a unanimous decision written by Justice Karen L. Valihura, the Delaware Supreme Court affirmed the Court of Chancery’s April 27, 2022, opinion in In re Tesla Motors, Inc. Stockholder Litigation. By: McGuireWoods LLP

JD Supra: Mergers

JULY 26, 2023

The Delaware Court of Chancery penned the latest chapter, on June 30, 2023, in a long-running dispute concerning TC Energy Corporation’s (“TransCanada”) July 2016 acquisition of Columbia Pipeline Group (“Columbia”), holding TransCanada liable for aiding and abetting breaches of fiduciary duty in Columbia’s sale process, and imposing damages upwards (..)

How2Exit

NOVEMBER 27, 2023

With a background in accounting and finance, Michael has built his company through mergers and acquisitions, gaining valuable experience in the process. rn Summary: Michael Ly, CEO of Reconciled, shares his journey in the accounting industry and how he built his company through mergers and acquisitions.

TechCrunch: M&A

JUNE 13, 2023

While Abe Yousef, Senior Insights Analyst didn’t specify exact figures, he said Monthly Active Users in May 2023 have fallen by 80% as compared to May 2016. Hence its rebranding to Sincere.

The New York Times: Mergers, Acquisitions and Dive

SEPTEMBER 12, 2023

Softbank’s chief executive, Masayoshi Son, believes the chip design company he bought in 2016 is poised to reap the fruits of the A.I. revolution.

The Guardian: Mergers & Acquisitions

SEPTEMBER 14, 2023

The company, owned privately by Japanese investor SoftBank since 2016, priced its shares at $51 each and sold 95.5m shares, raising $4.87bn for Softbank. Continue reading.

Shearman & Sterling

JULY 18, 2017

2016), the Court held the merger was "cleanse[d]" because "the disinterested stockholders of Diamond were fully informed and uncoerced when they overwhelmingly accepted the tender offer." § 251(h). Berkman, C.A. 12844-VCMR (Del. July 13, 2017). July 13, 2017). Relying on Corwin v. 3d 304 (Del. 3d 727 (Del.

Shearman & Sterling

FEBRUARY 14, 2017

On February 9, 2017, the Supreme Court of the State of Delaware affirmed the dismissal of a breach of fiduciary duty action brought by former shareholders of Volcano Corporation in connection with the acquisition of Volcano in a two-step all-cash tender offer and merger pursuant to Delaware General Corporation Law Section 251(h).

Shearman & Sterling

OCTOBER 3, 2016

On September 28, 2016, Vice Chancellor Sam Glasscock III of the Delaware Court of Chancery dismissed a shareholder challenge to the acquisition of Millennial Media, Inc. ("Millennial") by AOL Inc. ("AOL"). Barrett, C.A. 11511-VCG (Del.

Shearman & Sterling

JULY 25, 2016

On July 15, 2016, Judge Naomi Buchwald of the United States District Court for the Southern District of New York granted partial summary judgment to defendant Cowen & Company, LLC ("Cowen") on successor liability claims brought by Energy Intelligence Group, Inc. July 15, 2016). Energy Intelligence Grp., Cowen & Co.,

Devensoft

JUNE 1, 2023

Acquisition is a strategy that many businesses use to expand their reach and increase their market share. However, not all acquisitions are created equal. In this review, we will take a closer look at 11 powerful acquisitions that have taken place over the past decade. Here are some of the dos of successful acquisitions: 1.

Sun Acquisitions

AUGUST 2, 2024

Sun Acquisitions and its sign manufacturing clients know very well the sign manufacturing industry is facing significant challenges due to workforce shortages. To address this issue, many sign manufacturing companies are turning to strategic acquisitions as a viable solution. Finding and retaining skilled labor is difficult.

Shearman & Sterling

JULY 18, 2017

2016), the Court held the merger was "cleanse[d]" because "the disinterested stockholders of Diamond were fully informed and uncoerced when they overwhelmingly accepted the tender offer." § 251(h). Berkman, C.A. 12844-VCMR (Del. July 13, 2017). July 13, 2017). Relying on Corwin v. 3d 304 (Del. 3d 727 (Del.

Shearman & Sterling

FEBRUARY 14, 2017

On February 9, 2017, the Supreme Court of the State of Delaware affirmed the dismissal of a breach of fiduciary duty action brought by former shareholders of Volcano Corporation in connection with the acquisition of Volcano in a two-step all-cash tender offer and merger pursuant to Delaware General Corporation Law Section 251(h).

Shearman & Sterling

OCTOBER 3, 2016

On September 28, 2016, Vice Chancellor Sam Glasscock III of the Delaware Court of Chancery dismissed a shareholder challenge to the acquisition of Millennial Media, Inc. ("Millennial") by AOL Inc. ("AOL"). Barrett, C.A. 11511-VCG (Del.

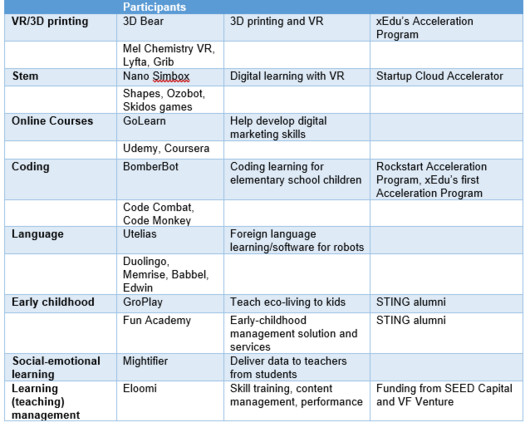

InvestmentBank.com

AUGUST 14, 2019

For instance, there was an increase in the teaching of online courses from 30% in 2016 to 42% in 2017. Students in the National Assessment of Educational Progress (NAEP) also demonstrated an enhancement in higher-order thinking and the ability to solve mathematical problems, regardless of the classroom size [3].

Sun Acquisitions

AUGUST 8, 2024

In the ever-evolving business landscape, mergers and acquisitions (M&A) are pivotal strategies for growth and expansion. Disney’s Acquisition of Pixar (2006): In 2006, Disney’s acquisition of Pixar Animation Studios sent shockwaves through the entertainment industry.

Benchmark International

OCTOBER 3, 2023

Benchmark International is pleased to announce the acquisition of Coventry-based LEVL by Canadian-based Banyan. LEVL, established in 2016 by Jan O’Hara and Andrew Pearce, is a key Geotab reseller in the UK and for electric vehicles (EVs) across Europe.

Shearman & Sterling

OCTOBER 3, 2017

On September 28, 2017, Vice Chancellor Sam Glasscock III of the Delaware Court of Chancery dismissed stockholder class claims for breach of fiduciary duty brought against the former directors of The Fresh Market ("TFM") after its acquisition in a two-step merger by affiliates of Apollo Global Management, LLC ("Apollo").

Shearman & Sterling

JULY 25, 2016

On July 15, 2016, Judge Naomi Buchwald of the United States District Court for the Southern District of New York granted partial summary judgment to defendant Cowen & Company, LLC ("Cowen") on successor liability claims brought by Energy Intelligence Group, Inc. July 15, 2016). Energy Intelligence Grp., Cowen & Co.,

InvestmentBank.com

OCTOBER 24, 2019

In fact, acquisitions by hospitals and private equity in provider services broke records last year according to Bain & Co’s 2019 global healthcare report. California has also been a hotbed of consolidation as the number of physicians in practices owned by hospitals has increased from 25% in 2010 to more than 40% in 2016 [24].

Devensoft

JUNE 20, 2023

Corporate development through mergers and acquisitions (M&A) is an increasingly popular strategy for companies seeking to drive innovation and growth opportunities. Strategic corporate development involves a systematic and disciplined approach to M&A, starting from identifying potential targets to post-merger integration.

Shearman & Sterling

FEBRUARY 21, 2018

On February 8, 2018, Justice Shirley Werner Kornreich of the New York Supreme Court denied a motion for final approval of a disclosure-only settlement in a class action suit brought by shareholders of Martin Marietta Materials, Inc. ("MMM") regarding its acquisition of Texas Industries, Inc. ("TXI"). City Trading Fund v.

Shearman & Sterling

OCTOBER 3, 2017

On September 28, 2017, Vice Chancellor Sam Glasscock III of the Delaware Court of Chancery dismissed stockholder class claims for breach of fiduciary duty brought against the former directors of The Fresh Market ("TFM") after its acquisition in a two-step merger by affiliates of Apollo Global Management, LLC ("Apollo").

Wizenius

APRIL 27, 2023

One specific area where these laws are frequently applied is in the context of merger and acquisition transactions. To prevent this from happening, governments often have laws in place that regulate mergers and acquisitions to ensure that they do not create or enhance a monopoly or otherwise harm competition.

The Harvard Law School Forum

OCTOBER 19, 2022

4] However, such exceptions were not universal and, as will be discussed below, the vast majority of dual-class charters adopted before 2016 that contained transfer restrictions did not include M&A voting agreement carve outs. more…).

Cooley M&A

FEBRUARY 8, 2018

No longer just “acquihires,” today’s innovation-driven acquisition is focused on talent retention. One familiar technique used by sophisticated tech buyers is a holdback structure that subjects a portion of key employees’ merger consideration to revesting. The typical revesting period for these arrangements is 24 to 36 months.

The Deal

JUNE 22, 2023

billion in 2016. Lam has done several other deals for Nasdaq, including its purchases of Solovis Inc. for an undisclosed sum in 2020; of eVestment for $705 million in 2017; and of International Securities Exchange Holdings Inc. from Deutsche Borse AG for $1.1 Thoma and Adenza tapped Peter Stach, Corey D. Fox, Bradley C. Reed and Michael P.

Sun Acquisitions

AUGUST 2, 2024

Mergers and acquisitions (M&A) have become a strategic tool for food distributors to achieve this diversification rapidly and efficiently. Brand Alignment The success of an acquisition often hinges on brand alignment. This ensures a cohesive brand image and facilitates smoother integration of product lines.

Benchmark International

APRIL 12, 2023

A challenging economic environment has cast uncertainty on the sector, but in a report by Irwin Mitchell that examined deal information from Experian’s Market IQ database, it revealed that 1,344 UK manufacturing businesses were the target of M&A activity in 2022, in comparison to 1,285 in 2021 and 1,231 in 2020, its highest level since 2016.

Shearman & Sterling

FEBRUARY 21, 2018

On February 8, 2018, Justice Shirley Werner Kornreich of the New York Supreme Court denied a motion for final approval of a disclosure-only settlement in a class action suit brought by shareholders of Martin Marietta Materials, Inc. ("MMM") regarding its acquisition of Texas Industries, Inc. ("TXI"). City Trading Fund v.

The Deal

FEBRUARY 1, 2024

GS) in 2011 but returned to Weil in 2016. After starting at Weil as a private equity associate in 2005, Machera went in-house as a private equity lawyer at Goldman Sachs Group Inc. (GS) He ended up doing work for people he met while he was at Goldman. “My My clients, by and large, are my friends,” Machera said.

Cooley M&A

OCTOBER 29, 2018

M&A practitioners have long advised boards of directors that the Delaware courts have never found that the events or circumstances in a particular transaction met the contractual standard of having a material adverse effect (or MAE) as defined in a merger or acquisition agreement. The Merger Agreement. 2018-0300-JTL (Del.

Devensoft

JUNE 19, 2023

Mergers and acquisitions (M&A) constitute intricate and frequently risky transactions with significant implications for stakeholders. Dell and EMC In 2016, Dell acquired EMC , a global leader in data storage, for $67 billion. This can help to ensure that the rationalization process is completed on time and within budget.

Peak Frameworks

SEPTEMBER 12, 2023

For instance, consider Tesla's acquisition of SolarCity in 2016. Remember the tumultuous acquisition attempt of Unilever by Kraft Heinz in 2017? Commitment: Clients showcase their seriousness about availing of services. Resource Allocation: Firms can better manage time and manpower when they’re assured of payment.

Peak Frameworks

SEPTEMBER 19, 2023

The oil price drop in 2015-2016, for example, forced many firms to adjust their budgets to the new market reality. This means budgeting not only for acquisition costs but also for future operational expenses, expansion plans, and potential exit strategies. Periodic Review and Adjustment: Budgets aren't static.

The Deal

APRIL 28, 2023

in 2016, and Firewalk was formed in 2018 to build sustainable game teams focusing on original AAA games — meaning large-budget titles produced by a major publisher. -based video games console developer Sony Interactive acquired Bungie Inc. The Deal then called Bellevue, Wash.-based based ProbablyMonters a potential M&A target.

MergersCorp M&A International

JANUARY 25, 2024

The deal will result in fresh funds flow into the Club for purpose of expansion, player development and acquisitions. Since Stephen Cleeve’s arrival in 2016, the club has beaten Port Vale and Doncaster in the FA Cup as well as playing Portsmouth, Walsall and Stevenage in the same competition.

The Deal

AUGUST 10, 2023

billion in 2016 , a deal that would be very difficult to pull off today, he said. (GE) on a $3.3 billion agreement to sell its appliances unit to Electrolux AB, a deal that fell apart for antitrust reasons. GE ended up selling the division to Haier Group Co.

Cooley M&A

SEPTEMBER 16, 2022

4] However, such exceptions were not universal and, as will be discussed below, the vast majority of dual-class charters adopted before 2016 that contained transfer restrictions did not include M&A voting agreement carve outs. Stockholder litigation. As always, ambiguity begets litigation.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content