European Stability Mechanism

Wall Street Mojo

JANUARY 14, 2024

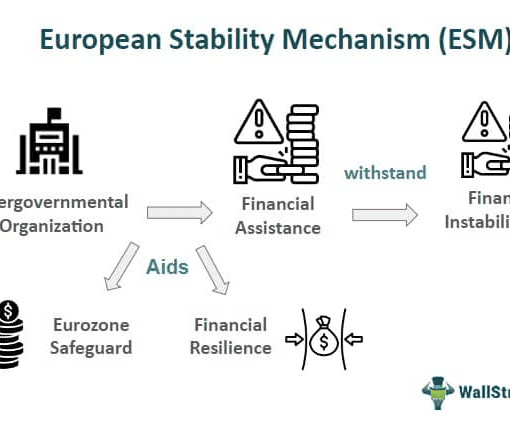

It contributes towards the recapitalization of banks and purchases sovereign bonds from secondary markets to stabilize euro nations. The European Stability Mechanism Board (ESM) operates as a financial backstop intergovernmental institution established in 2012 to combat the European sovereign debt crisis of 2009-2011 in euro member states.

Let's personalize your content