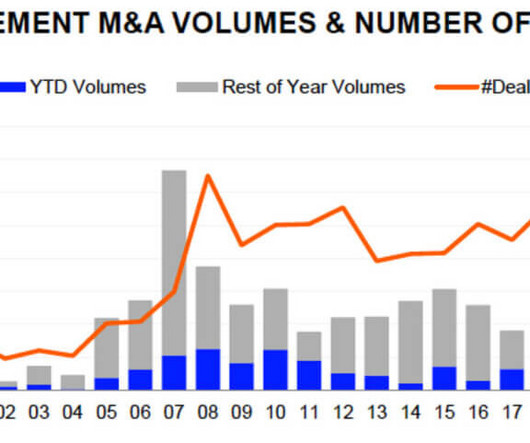

M&A is Back!

Solganick & Co.

MAY 13, 2024

May 13, 2024 – Los Angeles Business Journal – by Taylor Mills Solganick Says M&A is Back Los Angeles-based boutique investment banking firm Solganick & Co. Aaron Solganick founded the firm in 2009 after serving as the senior vice president of investment banking at B.

Let's personalize your content