[Hybrid Event] Navigating "The Deal": Antitrust and Corporate Complexities in Today's Rapidly Changing U.S. Antitrust Enforcement Regime - September 19th, Charlotte, NC

JD Supra: Mergers

SEPTEMBER 11, 2023

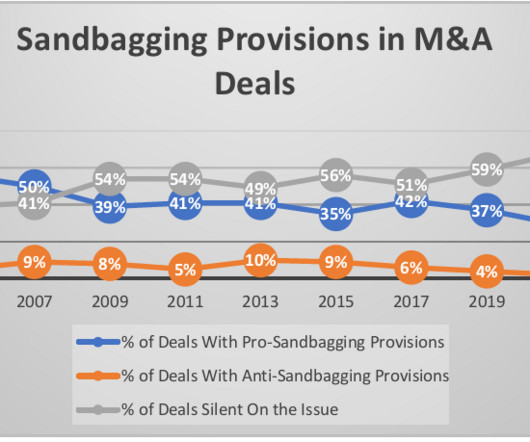

However, we are witnessing a once in a generation wholesale increase in the vigor and focus of antitrust as a tool for the government, with the US antitrust agencies recently announcing complete overhauls of the merger review process in the United States.

Let's personalize your content