Navigating Tech Due Diligence in the Era of Advanced AI: A Guide for Investors

Beyond M&A

MAY 14, 2023

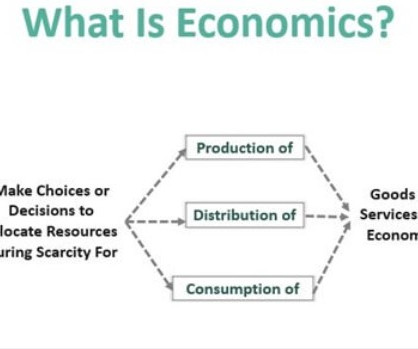

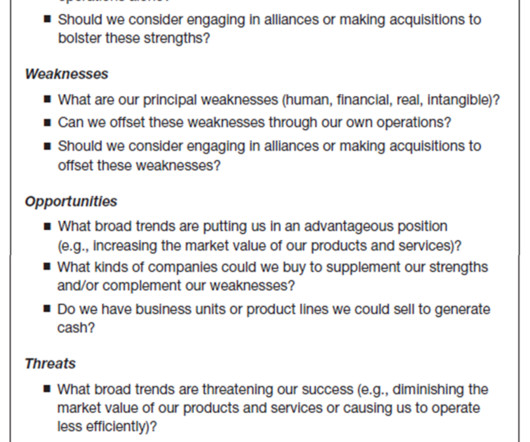

Let’s explore the key changes and provide some actionable tips for investors on why tech due diligence is more critical than ever in this brave new world of AI. AI and Its Impact on Tech Due Diligence In simplest terms, tech due diligence assesses a company’s assets, capabilities, and potential liabilities.

Let's personalize your content