In Tech Due Diligence, It’s Not About Perfect. It’s About Risk.

Beyond M&A

JUNE 17, 2025

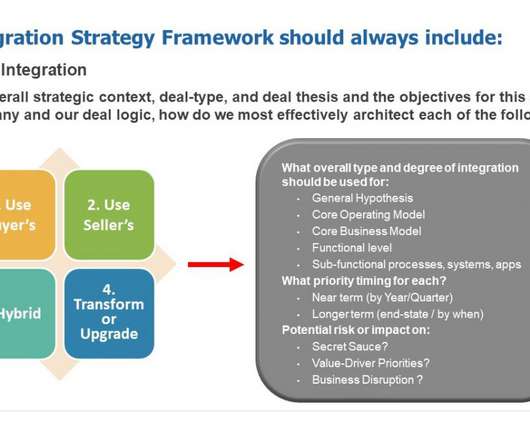

Our job in Tech Due Diligence risk assessment is to surface the risks that matter. Not every risk. Risk in a diligence context doesn’t mean “bad.” This is why a contextual, commercial lens is critical in Tech Due Diligence risk assessments. When you understand the risk, you can price it.

Let's personalize your content