The Unseen Hand: Tariffs and Their Profound Consequences on Mergers & Acquisitions

MergersCorp M&A International

JUNE 5, 2025

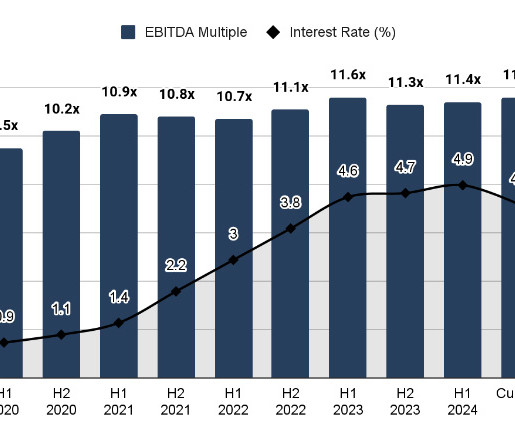

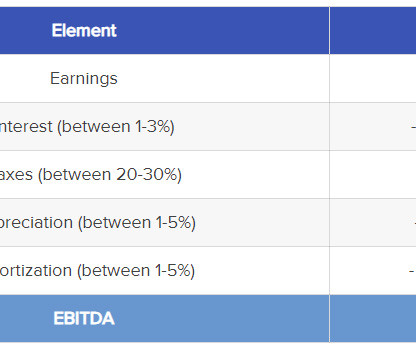

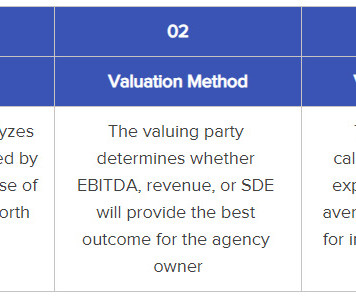

For businesses contemplating strategic transactions, tariffs introduce a complex web of financial, operational, and legal considerations that can fundamentally alter deal viability, valuation, and post-merger integration. Understanding these consequences is paramount for navigating the contemporary M&A environment.

Let's personalize your content