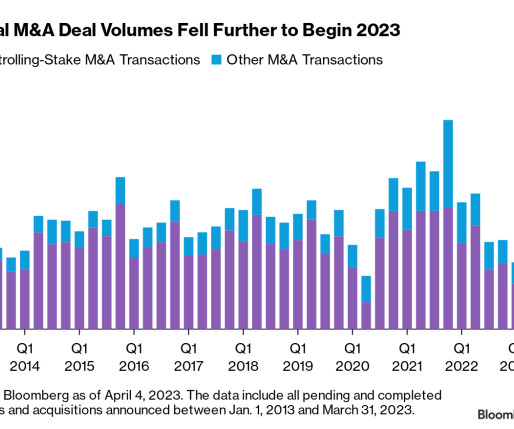

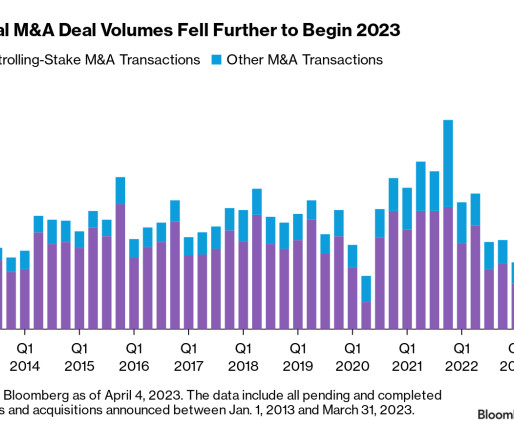

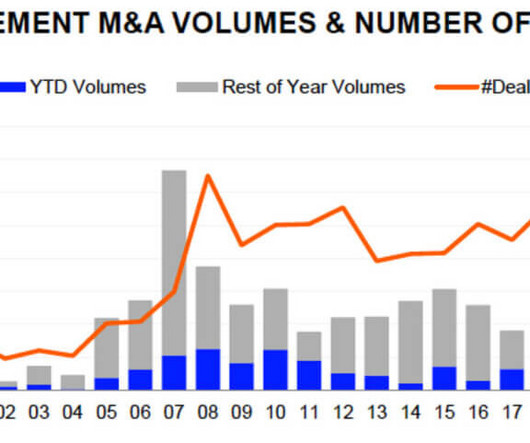

02-29-2024 Newsletter: How to Take Advantage of the Market Slowdown

OfficeHours

FEBRUARY 29, 2024

Slowdowns often bring increased volatility, tighter credit conditions, and, potentially, job insecurity. Written by a Top OfficeHours Female IB/PE Coach Access ALL OfficeHours Platforms for $29 each TODAY ONLY! First 50 Purchases Only!) Understanding the financial industry’s intrinsic link to the global economy’s fluctuations is crucial.

Let's personalize your content