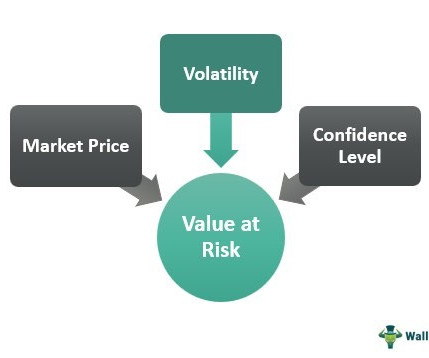

What is Value at Risk (VaR)? Definition and Basics

Peak Frameworks

SEPTEMBER 12, 2023

Value at Risk , commonly referred to as VaR, seeks to quantify the maximum potential loss an investment portfolio could face over a specified period for a given confidence interval. The choice depends on the nature of the portfolio and the objectives of the risk management exercise.

Let's personalize your content