Am I required to create a Financial Model from scratch or can I rely on a template?

Wizenius

JULY 30, 2023

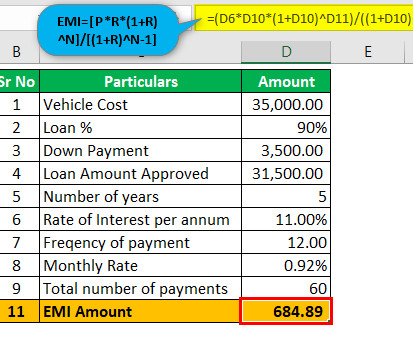

Given the extreme tight timelines faced by IB analysts to turn around financial models (deadline was yesterday!), Recreate blank templates of them if your organization has created few pre-defined models. Remember, a model is first created in your head and then in excel. Create a repository, your idea-bank!

Let's personalize your content