How to Stand Out in a Competitive Private Equity Associate Job Market

OfficeHours

JUNE 6, 2023

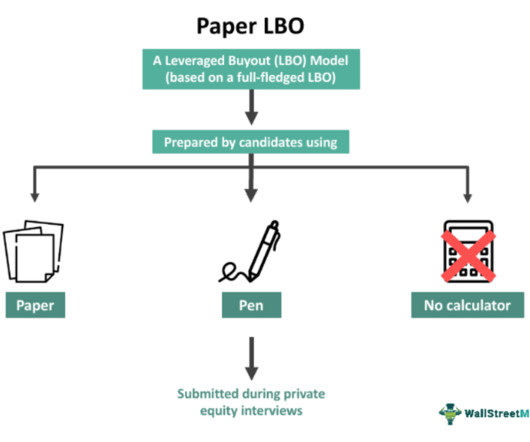

Seek staffing that is related to M&A deals that employ intense financial analysis and due diligence. T he most important skill for a private equity junior is financial modeling. Understand the key components that firms evaluate, such as market analysis, financial modeling, valuation, due diligence, and risk assessment.

Let's personalize your content