Your Key to International Market Success

MergersCorp M&A International

JANUARY 18, 2024

In addition to financial analysis and risk assessment, MergersCorp M&A International also provides expert advice on negotiating and structuring M&A deals.

MergersCorp M&A International

JANUARY 18, 2024

In addition to financial analysis and risk assessment, MergersCorp M&A International also provides expert advice on negotiating and structuring M&A deals.

OfficeHours

JUNE 6, 2023

Seek staffing that is related to M&A deals that employ intense financial analysis and due diligence. Understand the key components that firms evaluate, such as market analysis, financial modeling, valuation, due diligence, and risk assessment.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

MergersCorp M&A International

JANUARY 25, 2024

The firm conducts detailed financial analysis, assessing key financial metrics such as revenue, profitability, and cash flow. In addition to financial analysis, MergersCorp’s analysts also evaluate factors such as the target’s competitive positioning, market share, and growth potential.

Sun Acquisitions

FEBRUARY 26, 2024

Due Diligence: Paving the Way for a Smooth Integration The success of an M&A transaction hinges on thorough due diligence involving financial analysis, risk assessment, and evaluation of the cultural fit between entities.

OfficeHours

JUNE 5, 2023

By analyzing and dissecting these case studies, participants develop a practical understanding of deal execution, risk assessment, value creation strategies, and the challenges faced in the private equity industry. Participants are exposed to diverse investment scenarios, deal structures, and industry dynamics.

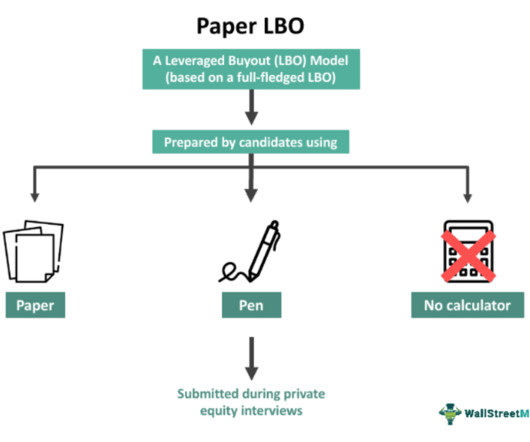

Wall Street Mojo

JANUARY 4, 2024

Purpose Its purpose is to assess the skills of a candidate by asking them to calculate the viability and profitability of a transaction without using a spreadsheet. A few other objectives include risk assessment, financial analysis, and negotiation strategy.

How2Exit

JULY 23, 2023

The Role of Risk Assessment and Deal Structure Another important aspect of successful M&A transactions is the ability to assess and manage risk effectively. Carvalho emphasizes the need for buyers to have a clear understanding of the risks involved and to develop strategies to mitigate them.

Let's personalize your content