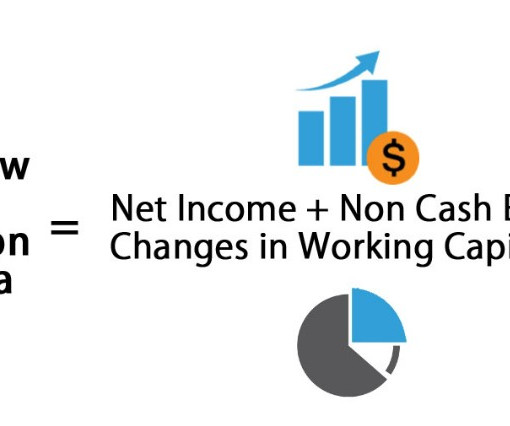

What is Cash Flow from Operations (CFO)?

Peak Frameworks

JUNE 7, 2023

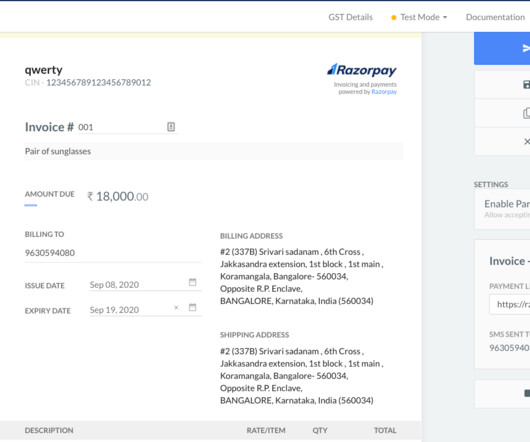

However, a look at the CFO shows a different story, mainly due to changes in their working capital, signaling potential financial stress. Software and Tools - Powerful financial analysis tools like Bloomberg Terminal, Capital IQ, and even Excel are widely used for CFO analysis.

Let's personalize your content