Educating Buyers and Sellers: Fostering a Deeper Understanding of Various Financing Models in Business Acquisitions

Sun Acquisitions

FEBRUARY 12, 2024

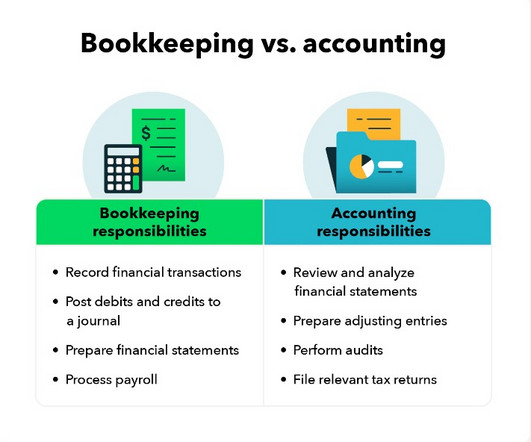

This article delves into educating buyers and sellers about financing models in business acquisitions. Financial Literacy: The Backbone of Informed Decision-Making Financial literacy is the foundation of sound decisions in business acquisitions. For buyers and sellers, this knowledge is nothing short of a game-changer.

Let's personalize your content