What’s The Graying Of Public Finance Really Mean?

H. Friedman Search

APRIL 27, 2023

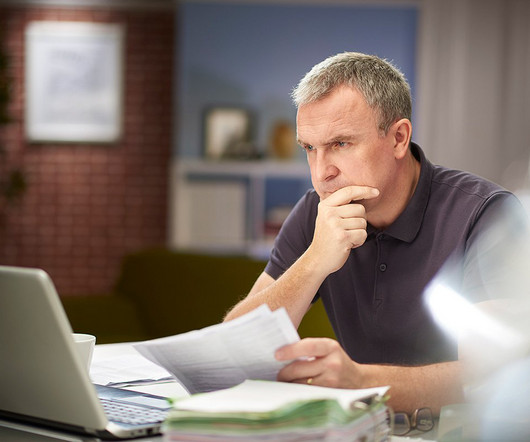

You would think a blanket statement like the “graying of public finance” would be a negative statement. And no matter how old you are, it’s a positive statement for the field of public finance. As the two top political leaders plan their ascent to the White House again, both contenders are going to be over eighty, whereas in most positions’ the retirement age is sixty-five or even younger.

Let's personalize your content