Contingent Value Rights: Key Components & Trends

Deal Lawyers

MAY 24, 2023

Contingent Value Rights, or CVRs, are the public company analog of an earnout, and like earnouts are a tool for bridging valuation gaps between buyers and sellers.

Deal Lawyers

MAY 24, 2023

Contingent Value Rights, or CVRs, are the public company analog of an earnout, and like earnouts are a tool for bridging valuation gaps between buyers and sellers.

OfficeHours

MAY 24, 2023

Investment banking is one of the most sought-after careers in the finance world. Investment banking is highly desirable due to its potential for high lifetime earnings, its interesting and impactful work, and it serves as a springboard for a career in finance. Getting your dream job as an investment banker typically requires a combination of education, relevant work experience, and networking.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

JD Supra: Mergers

MAY 24, 2023

Like most other enterprises that raise and spend capital, the federal government finances its spending in part through the issuance of debt. The federal debt limit is the maximum amount of money that the federal government is allowed to borrow to meet its legislatively mandated spending obligations, as originally enshrined in the Second Liberty Bond Act of 1917.

OfficeHours

MAY 24, 2023

Congratulations! You’ve got your dream private equity! But that is just the first step of the private equity journey. Now, it is time to hunker down and build your career. Building a thriving career starts with climbing the ladder. Private equity firms are typically very hierarchical, with multiple levels of professionals needing to move up to make it to the title of MD or Partner.

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

JD Supra: Mergers

MAY 24, 2023

As they go through their initial public offering (IPO) and the subsequent merger & acquisition (M&A) process, special purpose acquisition companies (SPACs) face many regulatory, legal, and business hurdles. Obtaining the appropriate amount and type of insurance for each stage of their life cycle is one of them. However, with some smart preparation and the expertise of the right advisors, insurance can go from being a necessary burden to a strategic asset.

Growth Business

MAY 24, 2023

By Dom Walbanke on Growth Business - Your gateway to entrepreneurial success In this guide, we look at how scale-ups can maximise their chances of getting an angel investor onboard. Don’t expect to achieve funding straight away. Angel investors want to make sure that they have the right team of fellow investors in place, and that takes time. If you want to get an angel investor to back you, it’s about the quality of your product or service and the effectiveness of your pitch.

Investment Banking Today brings together the best content for investment banking professionals from the widest variety of industry thought leaders.

The New York Times: Banking

MAY 24, 2023

In the Federal Reserve’s last meeting, “several” participants thought rates may have moved high enough to get inflation under control.

JD Supra: Mergers

MAY 24, 2023

M&A and shareholder litigation is off to a busy start in 2023, with Delaware courts issuing several interesting opinions. The Delaware Supreme Court reversed a Delaware Court of Chancery decision, finding that the “maximum flexibility” of drafting partnership agreements under Delaware law entitled the general partner to a conclusive presumption of good faith, even where the general partner’s actions negatively affected minority unitholders.

TKO Miller

MAY 24, 2023

It would be fun to write an aggressive "stick it to the man" article, but this will not be that. Instead, I will be exploring the much more common scenario where a manager, or group of managers who run a business for an absentee owner think to themselves, "we are doing all the work and creating all the value, why don't we buy all or part of this company?

Financial Times - Banking

MAY 24, 2023

Longtime chief executive seeks to buck ‘horrific’ Wall Street record for handing over top jobs

Speaker: Brian Muse-McKenney, Chief Revenue Officer & Matt Simester, Cards and Payments Expert

In today’s world of social media, dating apps, and remote work, businesses risk becoming irrelevant (or getting "ghosted") if they fail to meet the evolving needs of Gen Z consumers. Credit cards with flexible payment options, especially for young adults with little-to-no credit history, are a particularly important and valuable solution for this generation.

PE Hub

MAY 24, 2023

Duraco is a manufacturer of specialty materials including pressure sensitive tapes and labels, coated films, and release liners. The post OpenGate-backed Duraco scoops up coating technologies manufacturer Strata-Tac appeared first on PE Hub.

The Guardian: Mergers & Acquisitions

MAY 24, 2023

CMA says it is defending cloud gaming market, but Microsoft says moves ‘discourages tech innovation and investment’ in UK Microsoft has filed an appeal against the UK competition watchdog’s decision to block its $69bn (£56bn) acquisition of the Call of Duty creator Activision Blizzard. The US tech company confirmed that it had formally lodged an appeal against the Competition and Markets Authority (CMA) verdict against the deal last month.

PE Hub

MAY 24, 2023

IMO is a provider of clinical terminology management and data quality solutions for healthcare. The post THL-backed Intelligent Medical Objects buys healthcare data analytics firm Melax Tech appeared first on PE Hub.

Mergers and Inquisitions

MAY 24, 2023

“Event-driven hedge funds” is one of the more confusing labels in finance. Part of the issue is that many different strategies fall within the “event-driven” category: merger arbitrage , activist investing , distressed investing, special situations, and more. But the other problem is that all hedge funds are “event-driven” because they invest based on catalysts , or specific events that could change a security’s price.

Advertisement

The complexity of financial data, the need for real-time insight, and the demand for user-friendly visualizations can seem daunting when it comes to analytics - but there is an easier way. With Logi Symphony, we aim to turn these challenges into opportunities. Our platform empowers you to seamlessly integrate advanced data analytics, generative AI, data visualization, and pixel-perfect reporting into your applications, transforming raw data into actionable insights.

PE Hub

MAY 24, 2023

Canadian Dermatology Centre is a Toronto-based dermatology, plastic surgery, medical spa and skin care company. The post Fengate-backed GraceMed bags Canadian Dermatology Centre appeared first on PE Hub.

Align Business Advisory Services

MAY 24, 2023

Align Business Advisory Services was recently featured in a Forbes article discussing the strength of mid-market M&A, despite broader macro volatility. Read the article on Forbes to learn more about our insights and expertise! The post We Talk to Forbes: Middle Market M&A Stays Hot appeared first on Align BA.

PE Hub

MAY 24, 2023

Reston, Virginia-based Agile Defense is a provider of digital solutions to the Department of Defense and other national security customers. The post Enlightenment Capital-backed Agile Defense buys cybersecurity firm XOR Security appeared first on PE Hub.

Razorpay

MAY 24, 2023

Instant Mudra is a fintech company that aims to make banking services accessible to communities that are unbanked and underserved. With Razorpay Optimizer, Instant Mudra was able to manage multiple payment gateways and boost its transaction success rate while pursuing the goal of transforming rural banking. In this case study, we take a look at the challenges Instant Mudra faced and understand how Razorpay helped provide a solution.

Speaker: Robbie Bhathal, Founder & CEO, and Matthew Acalin, Head of Credit Intelligence

In today's volatile financial environment, how confident are you in your company’s financial forecasting? To get the most accurate cash predictions that will lead to long-term financial survival, real-time data is critical. Innovative cash management strategies can lead to better credit opportunities, more sustainable growth, and long-term financial prosperity.

PE Hub

MAY 24, 2023

PE goes bullish over healthcare tech. The post PE chases opportunities in healthcare tech, Centre Partners completes two-asset GP-led appeared first on PE Hub.

The Deal

MAY 24, 2023

Shareholder proposal activists were expected to launch director contests this year by taking advantage of new universal proxy card ballot rules making boardroom battles cheaper. But David Hunker, shareholder activism defense leader at Ernst & Young LLP, explained to the Activist Investing Today podcast that these shareholder-proposal insurgent managers haven’t nominated directors, at least so far, because they lack financial resources, can’t identify quality director candidates,

PE Hub

MAY 24, 2023

The deal is intended to help Canadian organizations reach their decarbonization targets. The post CIB provides C$100m to Johnson Controls and Apollo JV IonicBlue appeared first on PE Hub.

Peak Frameworks

MAY 24, 2023

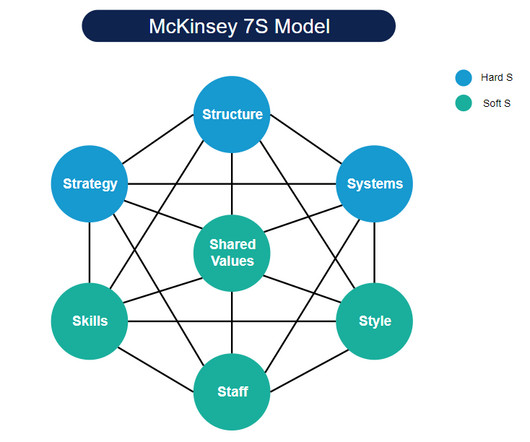

The McKinsey 7S Model , a managerial tool developed in the late 1970s by consultants at McKinsey & Company , provides a holistic approach to organizational effectiveness. It emphasizes the interconnectedness of seven key elements: strategy, structure, systems, shared values, skills, style, and staff. Understanding the McKinsey 7S Model Strategy Strategy is the plan an organization devises to outperform its competitors.

Advertisement

In the fast-moving manufacturing sector, delivering mission-critical data insights to empower your end users or customers can be a challenge. Traditional BI tools can be cumbersome and difficult to integrate - but it doesn't have to be this way. Logi Symphony offers a powerful and user-friendly solution, allowing you to seamlessly embed self-service analytics, generative AI, data visualization, and pixel-perfect reporting directly into your applications.

PE Hub

MAY 24, 2023

He is based in Nashville. The post Bestige adds Bard as a partner to team appeared first on PE Hub.

Peak Frameworks

MAY 24, 2023

Derivatives are financial instruments that derive their value from underlying assets (such as stocks, bonds, commodities, currencies, interest rates, and market indexes). For example, an option is a derivative that derives its value from a stock. The advent of derivatives in the 1970s marked a significant milestone in global finance, offering a structured risk management approach and fostering efficient price discovery.

PE Hub

MAY 24, 2023

Increasing need for digitization and cost efficiency is propelling growth in healthtech: IK’s Anders Petersson. The post PE firms tout growth in healthtech appeared first on PE Hub.

Peak Frameworks

MAY 24, 2023

In this post, we will explain the concept of a corporation , its types, benefits, and challenges, and how it influences the economy. The Basic Structure of a Corporation In essence, a corporation is a legal entity distinct from its owners, capable of rights and obligations similar to an individual. It can own assets, enter into contracts, and even sue or be sued.

Advertisement

In the rapidly evolving healthcare industry, delivering data insights to end users or customers can be a significant challenge for product managers, product owners, and application team developers. The complexity of healthcare data, the need for real-time analytics, and the demand for user-friendly interfaces can often seem overwhelming. But with Logi Symphony, these challenges become opportunities.

PE Hub

MAY 24, 2023

Pavion is a provider of integrated solutions for fire, safety, security and critical communications. The post Wind Point-backed Pavion buys commercial fire alarm provider Premier appeared first on PE Hub.

Tyton Partners

MAY 24, 2023

At the 2023 ASU+GSV Summit, our Founder and Managing Partner, Adam Newman , hosted a discussion on on microschools and parent power in K-12 education. He was accompanied by Odyssey CEO & Founder Joseph Connor, The Oakland REACH CEO Lakisha Young, VELA Education Fund CEO Meredith Olson, Prenda Founder & CEO Kelly Smith, and Avalanche VC Managing Director Katelyn Donnelly.

PE Hub

MAY 24, 2023

Based in Toronto, Seabridge Gold is a gold exploration and mining company. The post Seabridge Gold to raise $150m from Sprott for BC mining project appeared first on PE Hub.

Tyton Partners

MAY 24, 2023

At the 2023 ASU+GSV Summit, Kristen Fox joined a discussion on leading impact investors in EdTech. She was accompanied by Amira Learning CEO & Co-Founder Mark Angel, Southern New Hampshire University President Paul Leblanc, Edmentum President & CEO Jamie Candee, Rochester Public Schools Superintendent of Schools Kent Pekel, Tyton Partner Managing Director Kristen Fox, and moderated by McKinsey & Company Partner Jake Bryant.

Advertisement

Generative AI is upending the way product developers & end-users alike are interacting with data. Despite the potential of AI, many are left with questions about the future of product development: How will AI impact my business and contribute to its success? What can product managers and developers expect in the future with the widespread adoption of AI?

Let's personalize your content