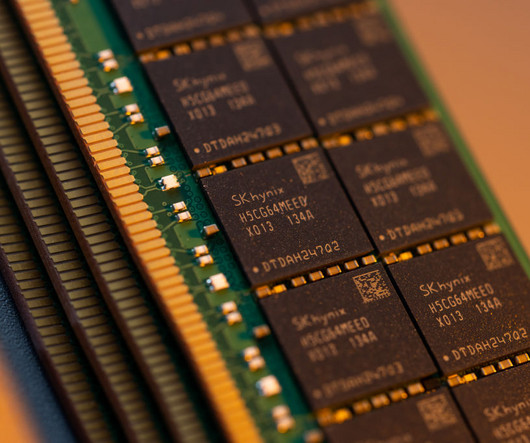

Memory chip maker SK Hynix, a shareholder of Kioxia, opposes a merger with Western Digital

TechCrunch: M&A

OCTOBER 26, 2023

A long-expected merger of two of the world’s biggest memory chip companies — Western Digital and Japan’s Kioxia — may be hampered by one of Kioxa’s shareholders, SK Hynix. The South Korean chipmaker said during its earnings call today that it would not agree to a combination of the two players. “SK Hynix is not […] © 2023 TechCrunch.

Let's personalize your content