The Art of the Dealership: A Legal Road Map for Buying and Selling Automotive Dealerships

JD Supra: Mergers

JUNE 9, 2023

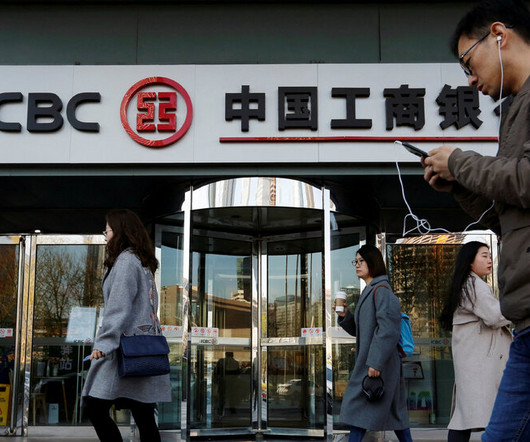

The past few years have seen dramatic shifts for mergers and acquisitions involving automotive dealerships. It has been estimated that approximately 3% of dealerships undergo a change of ownership in an average year.

Let's personalize your content