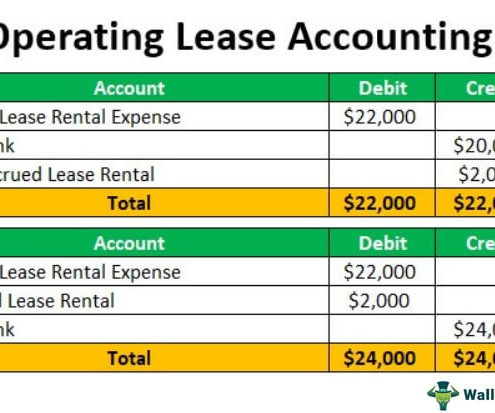

Operating Lease Accounting

Wall Street Mojo

JANUARY 15, 2024

Operating Lease Accounting Definition Operating Lease Accounting refers to the accounting methodology used for leasing agreements where the lessor retains the ownership of the leased asset. Impact The impact of the accounting can be seen on the balance sheet, income statement as well as cash flow statement.

Let's personalize your content