Will There Be an IPO for a Specialty Consulting Company in 2024?

Focus Investment Banking

JANUARY 18, 2024

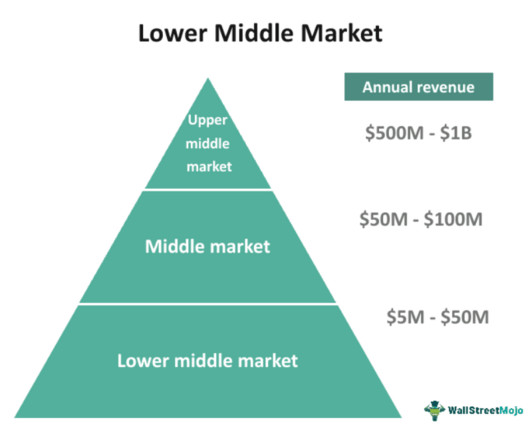

There are only a few publicly traded companies in specialty consulting. But those companies have been public for more than 20 years. While the company generated over $260 million in revenues through the first three quarters of 2023, its stock price is trading under a dollar a share, as the company is burdened with substantial debt.

Let's personalize your content